Perspective on Platform Businesses

Dear Investors,

I am pleased to share our new note as a part of our ‘Knowledge Series’ initiative on Platform Companies. In the previous note, Parin, had explained various Return Ratios in detail.

Over the years, we have been used to evaluating linear business with a pre defined supply chain where each component in the chain adds value. They grow steadily by re-investing profits/cash flows into new assets/people to achieve profitable growth. However, platforms require minimal investment and no defined supply chain to grow exponentially for a long period of time. As only few platforms succeed; through this note, we wish to discuss the important facets and try to provide a checklist on how to separate the wheat from the chaff.

What are platforms?

Platforms allow various consumers and producers to interact for various resources which can be accessed on demand by creating large scalable networks via technology. They help solve day to day problems, making our lives efficient and we cannot imagine living without them. Platforms can improve: a) social interaction (Whatsapp, Facebook, Tinder), b) information collection (Truecaller), c) online marketplace (Amazon, Uber) or d) merge hardware and software (IOS, Android). Some of the biggest known global platform companies are:

Indian platforms are present in various segments like foodtech, e-commerce, healthtech, gaming, fintech and edutech. Popular Indian platforms are:

Why did platforms emerge?

Platforms reduce friction and transaction costs, improve customer experience and convenience by providing more accessibility and speed, to fulfil customers demands in a more personalized way. Platforms connect 2 or more mutually dependant groups in a way that benefits every participant. Platforms emerged due to:

1) Inefficient existing business models (high transaction costs and low convenience)

2) Large untapped supply (underserved network)

3) High fragmentation

Why didn’t platforms emerge earlier?

During the dotcom boom, Internet was supposed to revolutionize business but landed up only helping gather and transmit data (improved efficiency) and there were no network effects. However today its different, as multiple facilitators (some of which existed earlier too) are all getting faster and compounding each other’s growth to turbocharge these platforms into making them more efficient and reducing transaction costs. Some of the facilitators are:

1) Smartphones (mini computers) due to fast improving processing power

2) Faster and cheaper data/broadband

3) Internet and Worldwide Web penetration

4) Cloud (easier and cheaper storage of data)

5) Connected devices/sensors (higher data collection and analytics)

6) Capital availability

7) 3rd party API (Application Programing Interface) economy which can outsource functions of platform like customer experience, maps, payment gateway, security, etc.

What are the stages in a lifecycle of a platform and key addressable points at each stage?

1) Early Days/Foundation Stage – Testing stage of an idea where the business model and unit economics should be established = customer acquisition cost (CAC) to Long term customer value (LTV). Foundation of the company is important and hence quality of customers, quality of employees (aligned with the long term vision of the company), and founders wavelength, defined responsibilities and decision making are important. The platform must be nimble so it can adapt quickly and must invest in habit creation.

A. Biggest question – does it have a substantial impact on our day to day lives and can we live without it – Think Uber/Amazon/Swiggy.

- Example: Alibaba (e-commerce) solved 5 B2B/B2C problems in China

- limited geographic presence of physical retail (land was expensive in China),

- buyer/seller fragmentation (Alibaba sold local, global, branded, unbranded),

- limited information/communication (users could interact freely on Alibaba),

- small scale (B2B/SME players were small until Alibaba boosted their growth)

- trust (Alipay = money kept in escrow till transaction okayed by both parties and they also introduced a ratings system for each user)

B. Strong business model/unit economics – Overall pricing, balancing interests of participants and understanding each one’s sensitivity to pricing is key. Platform must decide whom to charge (access/usage fee) and whom to subsidize to balance both sides. Subsidies can be monetary subsidy to one side or both sides or loyalty rewards or user sequencing (priority to some users). Recurring or bundled services like Netflix/Amazon Prime help as they give predictability to cashflows.

- Example = A would pay 5$ to not watch an advertisement while B is okay to pay 20$ to show them. The Platform would pay A 10$ to watch and charge B 15$ to show it and pocket the 5$ to facilitate the interaction so all 3 are better off by 5$.

C. Play the role of a matchmaker – Organize commerce and information so the right consumers and producers are getting connected, interacting and transacting with each other to create a community. Initially it is important to dominate a niche area/optimize core transaction to ensure high switching costs and no competition. This helps attract marquee participants, makes screening more robust, gives more pricing power and limits competition.Marketing is important as users may not come immediately but subtle impressions may attract them later.

- Example: Amazon focused only on books e-commerce in its early days.

2) Inflection point/Scale up (the most critical stage) – After the idea is established and the foundation is created, this is the phase where rapid scale up must happen alongwith heavy investments. The platform must not only increase its user base multifold but also increase the frequency of customer transactions and cross sell other products. Customer experience and data mining is key.

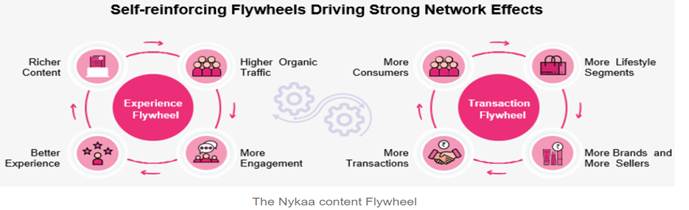

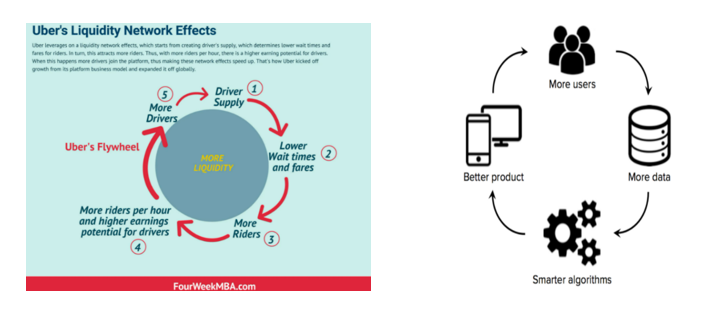

A. Creation of network effects (most important point in the checklist) – Buyers must attract more sellers which in turn attract more buyers creating a circular loop. This helps achieve critical mass or solving the chicken and egg problem but by balancing both sides. Quality of growth is vital (pull platform attracting high value users) and not discounting to grab consumers at all costs. As size grows, matchmaking becomes more difficult and hence good data algorithms need to be in place. Software is a commodity and can be replicated but the defensibility of the network is created at this stage.

- Example: Below charts show how the Nykaa and Uber flywheels work to create strong network effects which help in rapid growth of the platform.

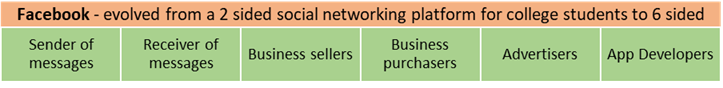

B. Ability to cross sell, increase customer lifetime value (LTV) or create adjacenices – Once the core transaction is perfected, the platform can use the real time data to quickly adapt to make it more sophisticated and personalized. The platform can also add adjacencies for cross selling easily as these are decentralized/automated/plug and play. Only common services like customer support are centralized. The platform must decide how many sides it will have.

- Examples: Adjacencies created by Uber – UberX, Uberpool, UberEats. Increase of LTV by YouTube as it evolved from showing only the most viewed global vidoes to using an algorithm to understand what videos each user likes and watches entirely (increased user time on platform = higher ad revenue). Increasing sides – Facebook:

C. Creating rules and standards – As size increases, complexity increases and platforms need to have strict rules and standards, use strong algorithms, encourage good behavior and let go own users that misbehave (creation of fake accounts or harassment on social media sites or misrepresentation on e-commerce websites). Trust is very important. Ratings help solve these problems to some extent but ratings can also be gamed and they are reactive in nature.

- Examples: Apple has defined criteria for look, feel, simplicity for 3rd party developer apps on the IOS platform. Social networks like Friendster/Myspace had no rules and hence got misused and eventutally died inspite of network effects but Facebook required a univeristy mail ID, was built on real life relation and expansion to non college users was gradual requiring a double-sided invite acceptance.

3. Modern Monopolies – The platform may be the last mover but if all the competition is wiped out when they reach scale, they will dominate for years. At scale (post network effects are established), good matchmaking is like finding a needle in a haystack and hence algorithms need to be even better. Also once domination is achieved, the platform has higher pricing power and hence higher profits.

A. Increasing Target Addressable Market (TAM) with efficient capital allocation – TAM must be growing in double digits to ensure strong future growth. Agood management understands evolving technology and must use the strong cashflows generated at this stage to take good capital allocation calls to increase future TAM.

- Example: Amazon has efficiently invested its cashflows from its successful businesses into funding many new business segments. This has kept its growth high for a number of years and ensured it can dominate multiple product segments.

B. Ability to integrate ancillary platforms making the base platform stronger.

- Example: Airbnb has given rise to the creation of multiple ancillary platforms: Urban Bellhop (helps in checkin, cleaning), Airspruce (professional helps creates Airbnb listing), Beyond Pricing/Price Lab/Smart Host (optimizes price for buyer, seller), Keycafe (pick up keys from local café)

C. Strong pricing power due to MOAT created by economies of scale, branding, IP, high switching cost and real time customization based on large database. Also many a times, the platform passes on the advantages of scale, to make it even more lucrative for its users. Effective network depends on the frequency and density of interaction between users and the sustainable value created.

- Example: Uber has strong pricing power and charges surge pricing as and when required. However as more customers join the platform and as driver-rider balance is established, they may make the platform more lucrative for drivers and riders.

Successful Platforms/Modern Monopolies can have a long lasting impact

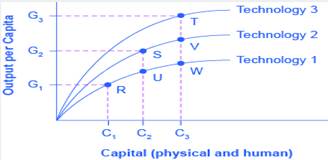

Platforms help users connect, allow them to communicate, curate for users based on feedback/ratings and create a community empowering every user. We have heard about the advantages of globalization and the world becoming flat. However, macroeconomics says that while improvements in labor/capital improve productivity to a certain extent, a positive technology shift can permanently alter the marginal productivity. Hence platforms are vertical progress and more impactful than globalization.

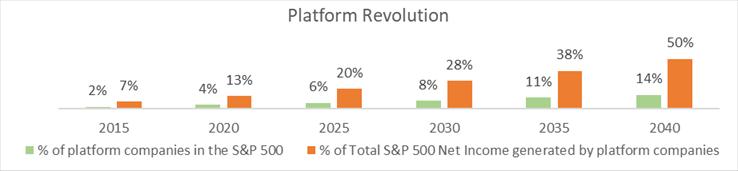

There is already proof in the pudding as although Indian platforms are at a nascent stage, currently 6 of Top 10 companies by market cap in the world are platforms/modern monopolies (Microsoft, Apple, Amazon, Alphabet, Facebook, Tencent). Alibaba too was part of this list 2 quarters ago. More platforms are expected to become modern monopolies and hence the % of platform companies in the S&P 500 and the % of total S&P net income generated by platform companies is only expected to grow.

Advantages of successful platforms

Traditional businesses are linear in nature (one seller interacts with one purchaser at a time) and built on a defined order of supply chain. Assets are physical or human in nature and the MOAT is generally the process or the efficiency in the supply chain.

Platforms have no pre-defined supply chain and multiple sellers and purchasers interact with each other. The asset of the platform or the MOAT is the matchmaking process and the quality of the customers on the network.

Advantages of a successful platform business (Think Airbnb vs any hotel chain):

A. No diseconomies of scale – In linear businesses, the thumb rule is that efficiency per unit increases by 25% if production increases by 2x, but after a certain size, there is diseconomies of scale due to bureaucracy, etc. Also in linear supply chains, one cannot make radical changes to the business/supply chain overnight. However platforms can adapt and change design whenever required due to the plug and play nature. Also more participants, means more data and the platform uses data for real time market research and the algorithms make real time decisions to customize for each participant and improve the value of the good or service.

B. Platforms benefit all – Traditional monopolies were despised as they never benefitted end consumers. However modern monopolies are a free market in a decentralized economy where users control the market and participation is voluntary. Also modern monopolies have not cut themselves a pie but grown the entire pie itself. If more people join, costs get lowered further and everyone wins.

C. Platforms have strong business dynamics – Linear businesses require profits and steady cashflows to fund new assets for incremental growth. However platforms require no re-investment and addition of each asset (customer) happens at a negligible marginal cost. They are much more agile (can easily cross sell) and they can grow exponentially with no investments. The combination of high ROCE with very high growth along with monopoly/domination or big market share gains makes it a superb investment proposition. Also generally managements are transparent with a strong pool of PE investors and the low fixed asset and working capital requirement ensures high PAT to free cashflow conversion.

What are the risks for a platform?

1) Survival – The biggest risk is that nobody knows how long a platform may survive as it can be disrupted. Generally it would be difficult to disrupt popular platforms that are already modern monopolies but platforms built on top of platforms (ancillary platforms) have a higher survival risk.

2) Platforms may not be applicable to all businesses – Platforms are useful when people need search and discovery or lower pricing (video store vs Netflix). Businesses like hyperlocal delivery are not sticky and there are other alternatives available like Kirana home delivery. In fashion too, people want to try before buying, etc. Hence cracking and establishing the unit economics at scale is important.

3) Legal risk (no laws are adopted as yet) – There have been numerous issues like counterfeit goods, fraudulent sellers, issues with Airbnb hosts, Uber and Swiggy drivers, fake profiles or lewd messages on social media. Uptil now, platforms have gotten away without any strict punishment as they have claimed to merely be a marketplace. Data privacy rules are also not clear as yet.

How to invest in platforms?

1) Firstly, and most importantly, invest only in platforms where cash flows are predictable and there is enough proof to suggest that the platform will survive – Since it is binary, only pick the ones with great unit economics where there are multiple building blocks which have created a strong ecosystem with no competition. Typically if a platform survives for a long time and becomes profitable, then there is a high chance that it would be a modern monopoly.

2) Secondly, like all other businesses, platforms are valued on the present values of future cashflows but the cashflows are backended – Unlike a traditional business where investments are routed through the Balance Sheet, a platform’s investments (subsidies, software, marketing, distribution) are routed through the Profit and Loss statement. These expenses are heightened in the early years to create the network effects but once an inflection point is achieved, there is a hockey stick growth in the profitability. Since one has to wait for a long time to see the cashflows, the above point becomes critical. High ROCE, high growth and the dominant position may justify premium valuations and high P/E of platform companies.

3) Lastly, like all other businesses again, management is most important – successful platforms generate a lot of capital and hence capital allocation becomes critical. Amazon has never raised money after its IPO and although profitability looks subdued, they have reinvested for growth and most of their current mature businesses are profitable today. Most big platform companies have a lot of cash on their Balance Sheets once they are mature.

Conclusion

From an Indian investor viewpoint, one can expect a spate of platform IPOs over the next 2-3 years. These IPOs would be across e-commerce, foodtech, fintech, ancillary segments to these and also newer evolving sectors with huge potential like medtech, blockchain, IoT (connected devices) etc.

Also, many Indian corporate houses like Tata, Bajaj, Reliance and global giants like Google, Facebook are trying to develop a super app where one app takes care of multiple services across segments. Tencent is a good example of a Super app wherein one can chat (WeChat), play games (freemium), pay bills, buy movie tickets, shop, gift, do charity and have pages on popular people or brands (like Facebook) – all on one app.

To conclude, we hope that this note provides a sufficient roadmap to analysing these companies. We at SageOne, will keep evaluating these new age companies to try and identify which platforms can be a success. Justifying valuation of these businesses will always be a challenge but we hope that over time, the scarcity premium of the already listed platform companies may diminish with more IPOs, hence providing more investable opportunities.

We look forward to hearing your valuable feedback and suggestions on this initiative of ours and on our part, we shall continue to take up interesting topics to help educate you further and in turn learning from you via your feedback. We hope you enjoyed reading this note.

Warm Regards,

Kshitij Kaji,

Senior Research Analyst

SageOne Investment Managers LLP

Yog Rajani,

Research Associate

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.