Demystifying the concept of “Cash Flow Adequacy”

Cash flow adequacy is used to determine whether the cash flows generated by the operations of the business are sufficient to pay for regular ongoing expenses – primarily payments made for long-term debt reduction, purchase/acquisition of fixed assets or capital expenditure and thereafter payment of dividends to shareholders. It is basically the ability of a company to convert its accounting profits into actual cash flows.

We all know that revenues and profits mentioned in the Profit & Loss account can easily be manipulated as the construct of Profit & Loss statement is on an accrual basis. However, it is not very easy to manipulate Cash Flows. As any source of capital expenditure or debt repayment comes from actual cash flows and not the Profit & Loss account statement, any misappropriation of Cash Flow Statement will ensure that the company eventually falls from grace. This makes it imperative for any company to convert its profits into operating cashflows.

We can measure the ability of a business to convert its profits (EBITDA, EBIT or PAT) into operating cash flows by a simple formula:

Cash flow Adequacy ratio = Operating Cash Flow (OCF) ÷ EBITDA

Or

Cash flow Adequacy ratio = OCF ÷ (Long term debt repayment + Fixed assets purchased + Dividend distributed)

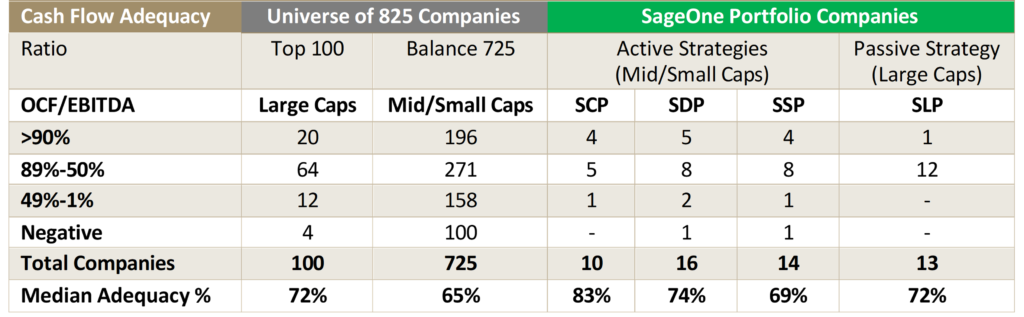

Higher the ratio, the more favourable it is. Let us now understand how listed companies in India are faring in terms of converting their profits to cash flows on FY20 financials. We have considered companies with Market Capitalisation > INR 500cr and excluded financials and real estate companies from the list (different business model / P&L of these sector companies). Thus, our universe consists of 825 companies.

We have also presented the same analysis for all SageOne portfolio companies (excluding any financials and real estate) across our strategies.

Source: ACE Equity Database

The following were the key takeaways from the table above:

→ Universe of 825 companies

1) Of the top 100 companies, more than 60% of the companies (64 companies) converted anywhere between 89% and 50% of their EBITDA into operating cash flow, signifying healthy cash flow adequacy among them.

2) Of the balance 725 companies, 27% of the companies (196 companies) were able to convert over 90% their operating profits in to operating cash flow in FY20. 14% of the companies (100 companies) reported a negative ratio, meaning that they were incapable of generating operating cash flow and relied on debt or further equity to support their capex or operations.

→ SageOne Portfolio Companies

1) 90% of SageOne Core Portfolio (SCP) companies (9 companies) were able to convert over 50% of their operating profits in to operating cash flow in FY20 out of which 40% of the companies (4 companies) reported cash flow adequacy ratio of over 90%. There was not a single company with negative ratio. The median cash flow adequacy ratio of SCP companies stood at healthy 83% on FY20 financials.

2) More than 80% of SageOne Diversified Portfolio (SDP) companies (13 companies) and more than 85% of SageOne Small & Micro Cap Portfolio (SSP) companies (12 companies) were able to convert over 50% of their operating profits into operating cash flow in FY20. The median ratio for SDP and SSP companies stood at healthy 74% and 69% respectively.

3) There was not a single company in SageOne LargeCap Portfolio (SLP) with a negative cashflow adequacy ratio (not even below 50%). It implies that all the companies successfully converted more than 50% of their operating profits to cashflows. These companies generally are cash rich and debt free. They are able to fund their capex through internal accruals and pay good dividends.

We believe, cash flow adequacy is as critical as Profit & Loss statement (sometimes more important depending on the industry the company operates in). Adequate cash flow works as a lifeline for a business to convert cash into revenue via capex, revenues to generate profits, profits to again convert to cash flows and the ability to reinvest that cash to again generate future revenues.

A high-quality business model will always have higher conversion ratio of profits into cashflow. Such companies will always end up having higher RoIC (Return on Invested Capital) than their cost of capital…one of the most important metrics for SageOne Investments Team to look for and monitor in a long-term wealth creator for our investors.

Warm Regards,

Parin Gala,

Vice President – Research & Fund Accounting

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.