SageOne Investor Memo July 2015

Dear Investors,

The recently concluded FY15 was a good year for the Indian markets with the Nifty 50 index gaining 26.7%, the BSE 500, BSE mid-cap and BSE small-cap indices gaining 33.2%, 49.6% and 54.0% respectively. This was the best year since FY10 and was clearly a year of changed sentiments towards Indian business environment triggered by high expectations from the new Government.

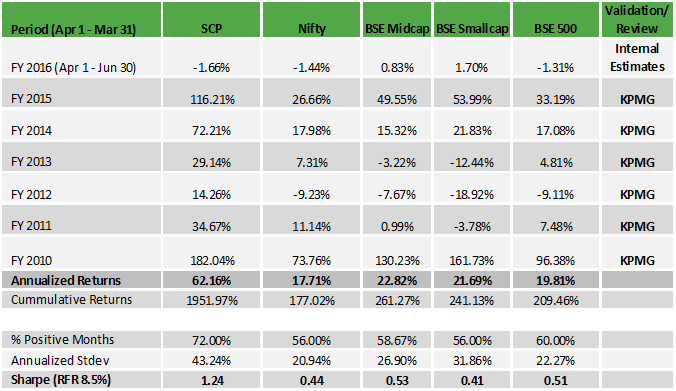

Portfolio Performance*

Below is the performance of our core portfolio for the last 6 years. Since clients have joined at various stages, individual performance may differ slightly based on the timing of purchases. For uniformity and ease we measure our performance using a “representative” portfolio (that resemble advice given to clients) and we call it SageOne Core Portfolio (SCP). SageOne core portfolio is not a dummy portfolio but the CIO’s actual total equity portfolio.

* For more granular details on the portfolio annual performance, please visit our website www.SageOneInvestments.com. We have consciously changed the composition of the core portfolio over time in terms of average size, number of stocks and quality of businesess. The weighted average size of stocks at the start in FY10 was below $0.25 bn which has increased to near $1.6 bn by the end of FY15. Also number of stocks have increased from 5-6 in 2009 to 14 (+/- 2) during the past 3 years. This was done by design to reduce volatility especially on the downside in the portfolio as annualized standard deviation has come down from average of 54% during the first 3 years to 17% during the last 3 years.

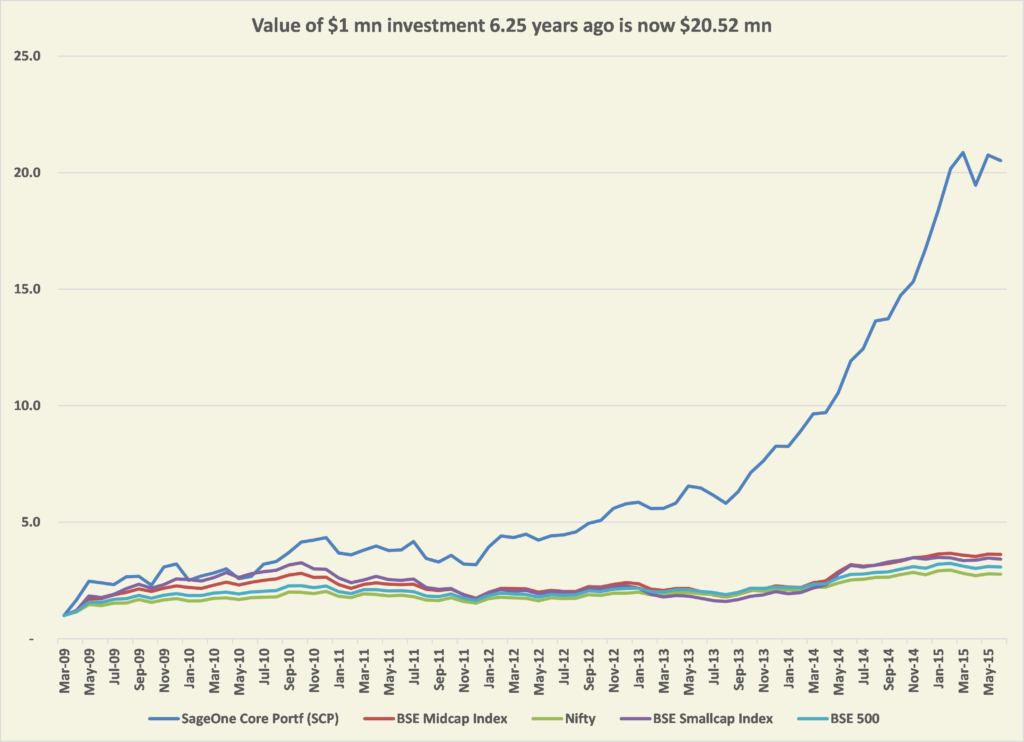

Following is a chart comparing cumulative performance of SCP with various indices over the past 6.25 years.

Time for Caution

Risk trade is back as reflected in the above table (FY15 data) by returns proportionate to the riskiness of the indices. Bulk of the returns were driven by increase in the valuation multiples rather than earnings growth. For the top 500 companies represented by the BSE 500, compared to the gains of 33.2% for the index the total Revenue/Sales was up only by 9.1% and Net Profits by 12.1% during the reported trailing twelve months (ttm). Surely lot of growth is expected from future earnings at a time when current earnings have been worsening. For the latest reported quarter (Dec’14), the companies in the BSE 500 index showed Revenue/Sales growth of just 1.4% and Net Profits de-growth of (14.2%) vs. the same quarter a year ago.

India went through an extremely disappointing business environment for five years before the May’14 elections due to the previous Government’s non/in-efficient execution that was characterized by flip-flops in decisions/regulations, tedious approval process that had come to a standstill and multiple corruption scams. No wonder most feel a sense of relief and optimistic about the new government led by the PM Mr. Narendra Modi who has had a successful track record in the state of Gujarat.

It’s been a hot market where investors are worried about missing out and not about losing money. As investors see people around them making money so easily, they tend to jump aboard. Many including the new investors have made multi bagger returns that typically give a false sense of confidence in their own ability to pick super investments and manage higher risk. Add to that the flood of liquidity/leverage available to foreign investors at virtually zero interest rates, and the result is an acceleration in the valuation multiples. Foreign Institutional Investors (FII) now own 42% of the free float vs 22% by Domestic Institutional Investors. Leveraged FII money tend to be short-term and can reverse its course at first signs of trouble creating very high volatility in the markets.

Many factors have aligned in the right direction for India. With low commodity prices (especially crude), inflation has been on a downtrend and RBI seem to be on a long path to lower interest rates. Globally commodity cycle is believed to have peaked for the foreseeable future and with rock bottom interest rates in developed markets, risk-return appear to be unfavorable for investors in major investable asset classes. Add to that lack of growth in most major economies and India with the new management looks relatively attractive to put capital. But the problem is, it’s a consensus view and investors have seldom made superior returns betting on such a view.

Is it Time to Sit Out?

With the current valuations and based on our expectations, let me try to put together a broad range of possible outcomes from a five year perspective and then evaluate whether it makes sense to be on the sidelines or stay invested.

Optimistic Scenario

During the last bull run of FY03-08, top 200 companies Revenue/Sales grew by 22.9% and Net Profits by 26.2%. Net profits been higher due to margin expansion. During the past 2 economic cycles (FY03-14), the average net margins have been around 10.4% (refer to my October’14 newsletter for detailed analysis at www.SageOneInvestments.com) which peaked at 12% in FY08 from 10.4% in FY03. Currently the Net Margins are at the lowest level of 7.7% and if the current favorable environment of low commodity prices, low inflation and declining interest rates is supported by increased demand and capacity utilization (operating leverage kicking in), Net margins can move towards the peak.

Assuming Sales growth similar to FY03-08 and margins improving to 12%, the earnings can grow at a CAGR of 34% during the next 5 years (4.5x returns). These can be further enhanced by valuation multiple expansion from the current ttm PEx of 19-20x for Sensex Index. Note that the Sensex PEx had reached above 28x in January 2008.

Realistic Scenario

Sensex Index earnings as well as India’s Nominal GDP have grown at 14% since 1993. India achieving similar growth over the next 5 years, we believe, is a high probability scenario along with Net Margins reverting to the mean of 10.4%. Please refer to the October’14 newsletter, wherein I have argued in support of margin expansion possibility and have sighted key reasons for it. Assuming topline growth of 14%, margin expansion mean reverting from 7.7% to 10.4% and PEx also mean reverting from current 19.5x to 16.6x, we can still expect to make around 17% annualized returns over the next 5 years (2.2x returns). This has been the long term annualized return for Sensex over the past 35 years.

Pessimistic Scenario

Much of the bullishness on India has been due to the change in Government, more specifically the election of Mr. Modi as the PM, supported by favorable commodity, interest rate and inflationary environment. Having such a high expectation from a single personality is highly risky especially given that India has had two episodes of PM assassinations since 1984. We have also seen the volatility in global commodity prices and India’s inflation over the past year. In case unfavorable scenario plays out and/or the new Government fails to deliver, not only will the earnings growth disappoint but the PEx can correct significantly. Since FY08 peak, Sensex earnings have grown at a CAGR of around 8%. In an unfavorable environment similar growth can continue and if we assume the PEx dropping to 11x (which is the low achieved in November 2008), we are looking at negative returns of around (3.5%).

During the seven year period FY08-15 when Sensex earnings grew at an annualized rate of 8%, our portfolio companies’ earnings went up by more than 35%. We believe that the next seven years are going to be better than the previous seven for the Indian economy. Indian population has become very demanding and less tolerant towards government’s inefficiencies. Modi or any other government cannot afford to take this change lightly. Without betting on favorable factors, we believe that there are going to be ample opportunities to pick great businesses if one follows a disciplined and consistent process. We would stick to our portfolio strategy (outlined in great details in previous newsletters: www.SageOneInvestments.com) and switch to new themes only after being highly convinced on its sustainability and growth potential.

Recently I happened to listen to Howard Mark’s talk, The Most Important Thing – “Origins and Inspirations”, which he gave at Google. I thought he explained investing beautifully using Tennis analogy. There is a difference between how amateur tennis players win a game compared to how champions do. Champions win by hitting winners and not by relying on the opponent making mistakes or “unforced errors”. Amateurs on the other hand mostly win by making lesser “unforced errors” compared to the opponent. Our endeavor is to find “winners” consistently by relying on high probability shots and at the same time staying away from “losers” by avoiding low probability shots.

We believe that there will be more winners emerging out of India in the next 5 years compared to the last 5. If your investment time horizon is short (1 to 2 years), then it’s a tricky period to be investing in and better to stay away. We are not good at timing the markets, but our defense strategy is to get in significant cash only at times when market valuations reach extremes i.e. beyond one standard deviation above long term normalized average based on combination of multiple metrics we track closely. We are not there yet and are able to find many attractive opportunities to invest in.

Our Portfolio Strategy

We continue to execute our strategy. Our portfolio is comprised of companies that have come out stronger through the tough economic environment over the past 7 years. They do not depend on favorable environment but positioned to benefit disproportionately if economic activity picks up on ground.

Warm Regards,

Samit S. Vartak, CFA

Chief Investment Officer (CIO) and Partner

SageOne Investment Advisors LLP

Email:sv@SageOneInvestments.com

Website:www.SageOneInvestments.com

*SageOne Investment Advisors LLP is registered as an Investment Advisor with SEBI.

For annexures, please download the PDF.

Legal Information and Disclosures

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.