SLMP Investor Memo April 2024

Greetings,

We take this opportunity to share our maiden memo since we started managing client funds in SageOne Large and Midcap Portfolio (SLMP) in August 2023. Through this memo, we would like to answer a few frequently asked pertinent questions about the SLMP offering.

What is our investment objective?

→ Investors seeking exposure in the LargeCap space can choose between passively managed Index Funds or actively managed Mutual Funds (MF). Index funds (by design), generate returns (adjusted for fee and tracking error) closer to the respective Index. Actively managed MF endeavor to generate superior returns to the index. However, their construct (excess diversification of ~40-80 stock portfolios) and design (index hugging approach) limit their ability to generate superior returns (i.e. alpha).

→ Our aspiration was to build an offering which has a higher probability to outperform alternate options in this category, by aiming for an alpha of 3-5% to the frontline Index (Nifty 50), net of fees and expenses (i.e. 16-18% absolute returns CAGR (compounded annual growth rate) = 2x portfolio in ~4.5-5 years). For the same, we hadmultiple iterations and discussions with our CIO, Samit Vartak and the team over almost 1.5 years, regarding investment framework, process and portfolio construct.

→ The outcome is a specially curated and concentrated bottoms up SLMP portfolio of 18-25 quality businesses, picked from the Top 200 Companies by Market Cap (as defined by the regulator – AMFI).

What are the catalysts for higher alpha generation?

A) Process of Selection and Allocation

→ Our process predominantly depends on earnings growth of companies which is similar to the process applied for other SageOne portfolios as well. We look for businesses that meet our stringent criteria of predictable earnings CAGR over 15-16%, superior quality of business and at reasonable valuations.

→ Our deeper assessment is on future operating metrics or underlying long term trends beyond the reported financials that are widely discussed/known to all. We had written an article recently on the importance of (Capital Allocation and Capital Efficiency) in evaluating businesses.

→ Since the large cap space is well researched, we need to be ahead of the curve. Our company / sectoral allocation is an outcome of the companies which fit our investment philosophy rather than mirroring any index construct. Our present Top holdings have no common names like Reliance, ITC, ICICI Bank, Infosys, Asian Paints, Bajaj twins, L&T, etc.

→ It is not only important to identify the right companies but also important to allocate a higher weight to higher conviction ideas. By adhering to a concentrated portfolio approach, we are able to allocate higher weights to selected stocks. We tend to allocate 3%-8% in a stock basis our conviction on the business fundamentals and valuation comfort.

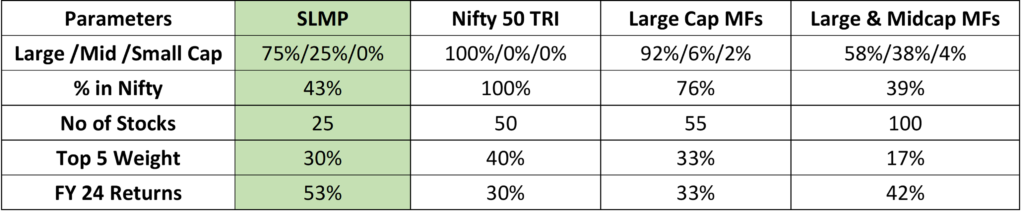

Current portfolio construct of SLMP compared to similar offerings

Note: MF Data is based on an average of the Top 5 MFs in each category by AUM (as on Mar 31, 2024). Source: Moneycontrol, Value Research

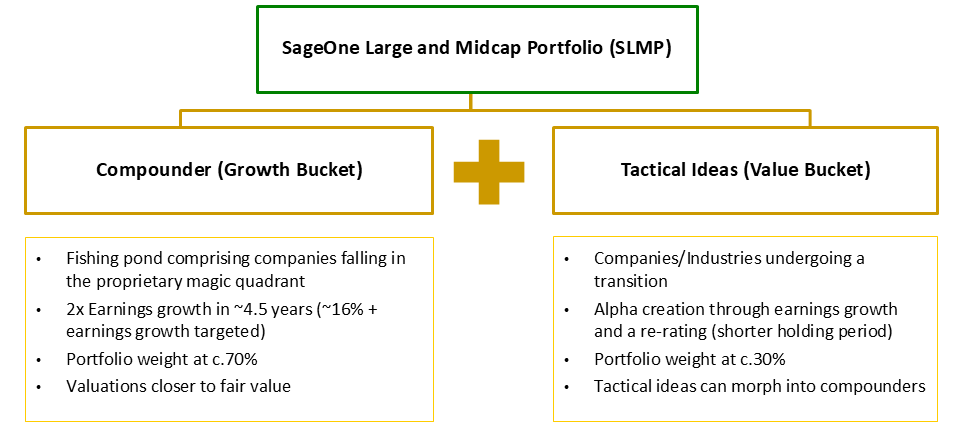

B) Dynamic Balanced Portfolio Construct – Blend of Growth & Value Opportunities

→ Different investment styles work at different times and for consistent alpha generation, it is important to understand companies from 2 different buckets – compounder (growth) and tactical (value).

→ The compounder bucket consists of companies with high predictability companies falling in our proprietary magic quadrant and available at reasonable valuations.

The tactical bucket consists of companies where the unpredictability of earnings and inefficiency in market valuation is expected to be corrected by triggers. This basket should aid meaningfully in alpha generation as it’s a combination of earnings growth and re-rating.

Our portfolio is an outcome of our constant focus to pick companies having superior growth and Return on Equity (ROE) metrics, at fair/reasonable valuations.

Source: Ace Equity, SOIM – All ratios are median numbers #Ex BFSI

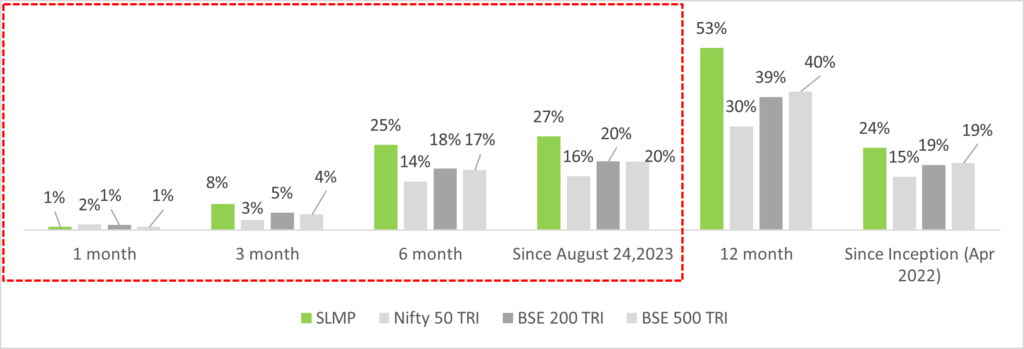

How has the SLMP performance been so far?

The SLMP returns (net of costs and fees) are a combination of managing proprietary funds from 1st April 2022 up to 24th August 2023, followed by managing client money since August 2023. The performance over this period has been encouraging but the focus remains more on the investment process rather than the performance. Also, this is a relatively short period to judge our performance and our endeavor remains to achieve consistent and stable alpha generation over long periods of time. We strive to keep refining our investment process proactively in accordance to evolving business/market cycles.

Note: Returns greater than 12 months are annualized returns. Returns of individual clients will differ from the above numbers based on the timing of their investments. Past performance is not an indication or promise of future performance. The performance related data has not been verified by SEBI.

→ Portfolio performance has been fairly distributed and not concentrated to one sector or one stock. Top 5 contributors to the overall portfolio return are all from different sectors and are as follows: Trent (Retail) , Canara Bank (BFSI), TVS Motors (Auto), Persistent Systems (IT), Cummins (Capital Goods).

→ While 4 of the above 5 names are from the compounder basket, some of our tactical names like Canara Bank, Coal India, NTPC, Indigo etc. have done well too. Canara Bank was one of our tactical/value bucket ideas which we have exited with returns of ~75% as our thesis on the re-rating of the bank, has played out.

What have been our key learnings?

As our portfolio process was formed after multiple iterations and discussions with our CIO, Samit Vartak and the team over almost 1.5 years, we remain confident about the same. Although the initial results have been encouraging, our endeavour is to constantly learn in order to limit errors of omission or/and errors of commission. Some of them are:

→ Zomato – Zomato has kept surprising positively over the last few quarters led especially by Blinkit. We were convinced on the food delivery business but were unsure on the viability of the quick commerce business model based on the operating metrics.

→ Bajaj Auto – Bajaj Auto was a miss due to our inherent bias based on the recent history of the company. We were unable to predict their success in EV inspite of being a late entrant. Overall, we were positive on 2 wheelers (TVS is a part of SLMP) and in hindsight, both TVS and Bajaj Auto should have been a part of the SLMP portfolio.

→ Star Health – Since formally launching, we have exited only 3 stocks with a combined weight of ~12%. Only Star Health was exited below our cost price, as it disappointed on various operating parameters such as profitability (combined ratio) and growth for a few quarters, and we felt that recovery was a while away.

What is the current outlook in terms of risk and returns?

→ FY15-FY19 was a very tepid phase for LargeCap earnings, reflected in single digit earnings growth in Nifty 50 with constant earnings downgrades. Post Covid, there has been a substantial improvement and growth in earnings, driven by government capex and a private capex upcycle, fueled by renewable capex, China+1 manufacturing boom, a real estate boom, and healthy corporate and government Balance Sheets. Long term growth prospects and sustenance of positive macroeconomic and corporate India prospects, places the fundamental outlook on a strong footing.

→ The large cap space represents the dominant pie in the Indian stock market but has significantly underperformed the midcap and small cap indices over a 3-year period and especially over the last 1 year. Large cap MFs have seen outflows over the last 12 months as compared to large inflows in the small and mid-cap MFs as of recent data. The time correction in LargeCaps along with mid digit earnings growth expectations going forward, puts LargeCaps valuations in a reasonable zone.

→ We feel that for anyone with a 4–5-year view, this still remains a good time to invest in the large cap space with potential to generate superior returns along with moderate risk.

→ Barring a few sectors with stretched valuations, we don’t envisage any pertinent domestic risk emanating. However interim volatility can be expected owing to global factors like ongoing geo political developments, monetary tightening policies by developed nations etc.

→ Equity markets have a characteristic of being nonlinear with markets witnessing drawdowns of 10-15% p.a. on an average including within periods of a bull mkt cycle. Therefore, for long term investors, it is more important to build capabilities to stomach such volatility in their journey of wealth creation through equities and not take decisions led by greed or fear.

To conclude, we hope to keep writing more such memos for our SLMP portfolio in the future to highlight our thought process, views on different subjects and take a deep dive into some of our key holdings. We wish to keep learning and improving our process along the way. While the initial performance has been good, we would like to keep focusing on our process and let the performance be an outcome of the process.

A clear thought process along with a disciplined approach is critical in increasing the odds of a successful investing journey. We have written about both these aspects in two knowledge series notes titled “Importance of Process in Investing” and “Spirituality and Equity Investing.”

The minimum ticket size for SLMP is INR 50 lacs and there is NO exit load. We have kept our fee structure extremely competitive vs other similar large cap funds. SLMP could be considered as an alternative or an option for any investor’s existing or new LargeCap equity allocation.

Samit’s guidance, experience of our research team and constant channel checks will continue to help us in the stock selection and elimination process of our portfolio going forward as well.

Thank you for always having faith in SageOne and we hope that we continue to deliver to our clients through this new offering and look forward to your participation.

Warm Regards,

Satish Kothari & Kshitij Kaji

Fund Managers, SLMP

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.