SageOne Investor Memo February 2018

Dear Investors,

2017 was a very favorable and generous year for equity investors wherein almost 90% of the BSE 500 companies delivered positive returns. Your time and allocation in the market mattered more than what you invested in. We were also beneficiaries of the environment and the SageOne Core Portfolio (SCP) closed the year with 56.4% returns, which is the fourth 50%+ returning year in the past 9 years for SCP. The portfolio is up 36.7x since inception in 2009. We also launched PMS (portfolio management services) offering on January 23rd 2017, which has returned 54% in 2017. We had targeted reaching US$100 mn assets under advisory by end of the year, but crossed that target well in advance and hence closed new subscriptions into the PMS. We are at initial stages of exploring a new investment product, Category III AIF, and will keep you posted.

Note: Our portfolio (SCP) performance is presented in the Appendices at the end of this memo

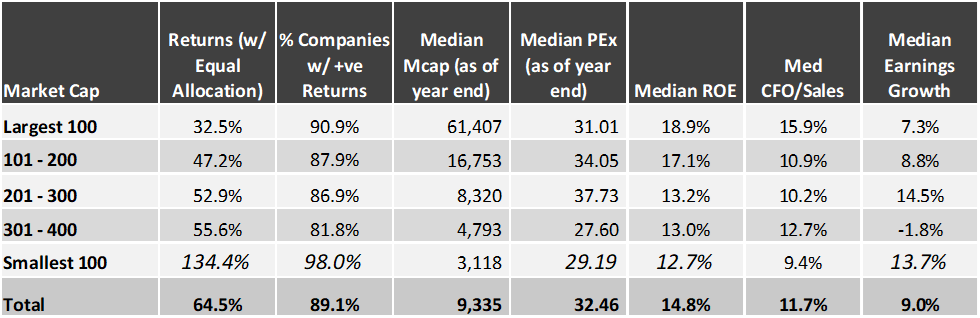

While the absolute returns of SCP for 2017 may seem high, they are not so extraordinary when one looks at the performance of the broader universe. Just looking at the performance of BSE 500 companies broken into 5 quintiles (based on market capitalization) provides a good insight into the broadness of the market performance. Micro, small and mid-cap stocks have been on a tear since September 2013, and the same trend continued. Returns have been directly proportionate to the illiquidity in the stock and hence smaller the size higher have been the returns.

Performance of a fund has to be compared with an appropriate universe. For SCP the average as well as median market capitalization of the portfolio companies was around 9300 crs at year end. If you compare us with the appropriate quintile, we have barely outperformed. The area which gave us satisfaction was earnings growth, which again surpassed 30% for the year and more than 3x of that for the BSE500.

Breakdown of BSE 500 Companies Performance in 2017

In continuation to the valuation analysis we released last month and other analyses I have presented in my earlier memos (SageOne Memos & Analysis) this table shows further stretching of valuations, especially for the small and mid-cap universe.

In this memo, I am presenting numbers comparing the above table with 2007 bubble as well as to the last 16 years. No question current valuation levels are unsustainable but I have also shown the perils of market timing in my previous memos. What one choses to do has to be consistent with his/her investment style. One may warrant completely exiting the markets, other may warrant over allocating in defensive sectors, some other may warrant hedging the portfolio and some may warrant just riding this through. Options are many for the exact same levels of the market. In the last part of this memo, I will provide my thoughts on this aspect and how we are navigating through this phase.

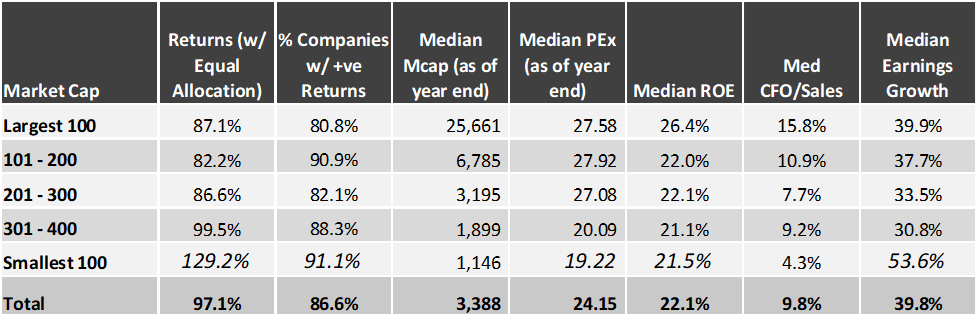

Comparing Current (above) with 2007 Bubble

Breakdown of BSE 500 Companies Performance in 2007

I believe median is the appropriate measure for this analysis, as simple averages can get skewed significantly due to outliers. For e.g. when earning for a company jumps from a very low base (e.g. 1000% when 1 cr jumps to 11 crs) the % growth of that company can skew the average. Similarly weighted averages are influenced too much by larger companies.

Below are some of my observations when comparing 2017 with 2007

→ In 2017, the returns for the smallest 100 companies (smallest quintile) were 4x that of largest 100 (largest quintile). The same differential was 50% in 2007.

→ As of end of 2017, the median PEx for the smallest quintile was 29.2x, which is 50% above the peak reached for the comparable group during the 2008 bubble.

→ At the end of the last bubble, largest quintile was trading at a 50% premium to the smallest quintile. Today smallest quintile is at par.

→ The returns for the smallest quintile during 2017 were 10x compared to the earnings growth.

→ The rally was indiscriminate both in 2007 as well as in 2017, but more so in 2017. From the smallest quintile, 98% companies delivered positive returns. The historical average is around 60%.

As of Dec 31, 2017 the total market capitalization for the BSE 500 companies was around 133.7 lac crores. Out of these the smallest quintile was around 3.76 lac crores or less than 3% of the universe. During a year when there was more than 1 lac crores of net inflow in the Indian equities market and everyone is running after Beta, there isn’t enough liquidity in the smallest quintile to absorb even small portion of the net inflow. But we all know that money follows returns and that’s been delivered by small/micro caps over the past 4 years. Funds have been crammed into this group resulting in stretching the boundaries of even the extremes.

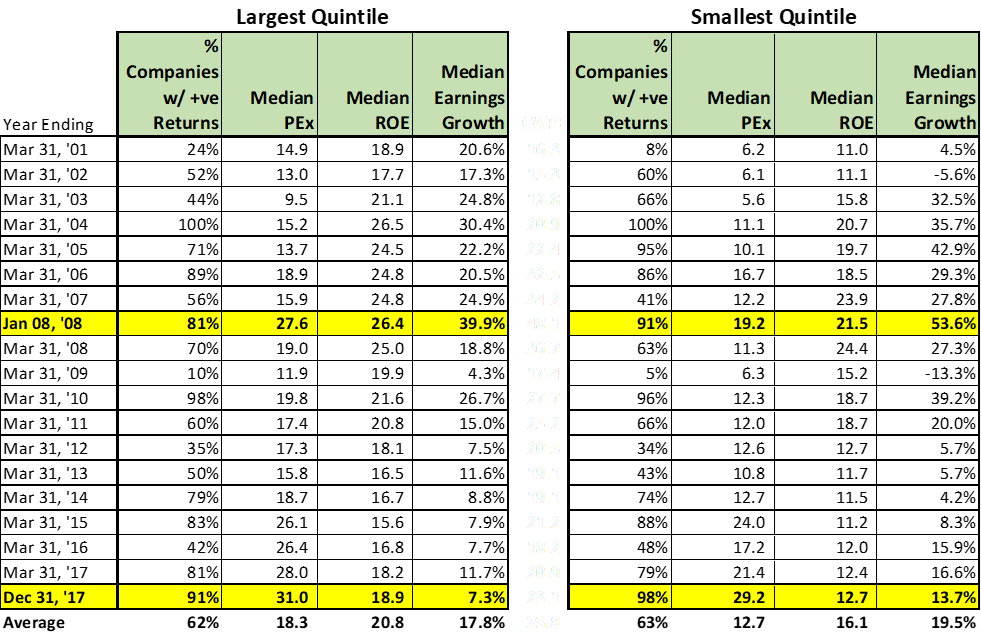

Today’s Levels in Longer Historical Perspective

Comparing today’s levels to the last 17 years provides a much better understanding of today’s relative levels. For this purpose, instead of using the BSE 500 companies, I have used our universe of around 500 companies we use for the annual valuation analysis. This universe is very similar to the BSE 500, but remain constant vs continuous changing composition of the BSE 500 and hence easier to analyze. At the start of every year, I have broken down the universe in 5 quintiles ranked by market cap. This means that the quintiles are reset at the start of every fiscal year. In the summary table and graph presented below, I am comparing the parameters for the two extreme quintiles only (since FY 2001) to showcase the extent to which current levels have diverged from averages.

The comparison with history is stark and needs no further comments. Problem is its use in predicting the future. Just because valuations have crossed historical peaks, doesn’t mean crash is coming. As Warren Buffet said:

“In the business world, the rearview mirror is always clearer than the windshield.”

If history forecasted future, we all would have been the best timers of markets.

Investment Style and Resulting Action has to be Consistent

There are countless ways of delivering superior returns (“alpha”) in the markets. Some can do it by timing the broad markets, some are experts in commodities and can time those business cycles well, some can be good at valuations, some can be good business pickers and the list can go on and on. If you are in the first 2 categories, “Buy and Hold” or “Don’t time the markets” kind of worldly investing wisdom can be risky. For them cash allocation and entry/exit timing is crucial. On the other hand if you are good at identifying long term structural businesses and valuing them, market timing can be risky. I can’t stress enough how critical it is to have alignment between your investment style and actions.

We believe that long term earnings growth is the best defense against risk of permanent capital loss. We are fine being reasonably flexible on valuations but not so on the business quality or earnings growth. In the long run, earnings end up determining your returns. If you buy it cheap the returns improve further and if you buy it expensive the returns reduce below the earnings growth. E.g. if you target 25% earnings growth, the earnings double in 3 years. Now even if the valuation corrects by 30%, you will still end up making 11-12% annual returns.

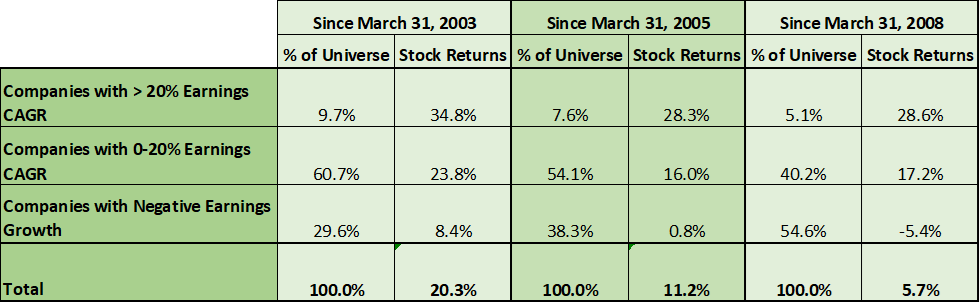

Problem is finding companies that can grow at such high rates over a long period of time. It’s definitely not easy and can be clearly seen from the below analysis of earnings (per share) growth rates in businesses over various time periods. I have considered 3 starting points viz. 1) Start of the previous economic cycle (post FY03), 2) Mid of that cycle (post FY05) and 3) End of that cycle (Post FY08). I have included all listed companies with minimum 10 crs net earnings at the start of each period.

% Companies Delivering Various Annualized Growth Rates until Dec ‘17

* Stock returns are assuming equal weighted portfolio at entry

As you can see, delivering > 20% earnings growth is extremely difficult over a business cycle and only 5-10% of the universe have been successful at it. For each company delivering >20% growth, there were 3-10x companies delivering negative earnings growth. Over a short period, there may be many companies with such high growth, but sustaining that over longer period is exceptional.

In a favorable and generous equity environment such as the recent past, investors give benefit of doubt for growth to all companies indiscriminately. E.g. one assumes the market share gain (unorganized to organized) from GST implementation to all. In reality the benefit will be concentrated in the top 10 or max 20% of the companies which are most efficient and have the right strategy. In the short run, stock prices of all companies go up, but very few of them would be able to support those with earnings growth. That’s where the difficult part of investing comes in and that separates the wheat from the chaff.

We strive to find such companies. In doing so, we break up the periods into smaller durations of 2-3 years and track companies closely to evaluate whether the earnings growth can sustain above our targeted (20% at company level and 25% at the portfolio level) hurdle over that period.

Employing our investment strategy and a disciplined (quality as well as valuation) investment process, we have been able to find portfolio companies that have grown their earnings (weighted average) annually by more than 35% over the past 6 years when the Nifty 50 as well as BSE 500 companies have increased their earnings in single digits.

Even in the current environment we are finding companies with our targeted earnings growth. Of course valuations are not cheap, but neither are they beyond comfort yet for these specific businesses. If the portfolio business valuations move well beyond our comfort zone, we prefer to exit and find better alternatives. Company level valuation matter more than the macro.

Currently we have single digit cash % levels in our portfolio. We expect that we would be forced to exit out of multiple positions with no better alternatives if and when valuations for our portfolio companies move uncomfortably beyond our range. The strategy though will not change and we stay our disciplined course.

Warm Regards,

Samit S. Vartak, CFA

Chief Investment Officer (CIO) and Partner

SageOne Investment Advisors LLP

Email:ir@SageOneInvestments.com

Website:www.SageOneInvestments.com

*SageOne Investment Advisors LLP is registered as an Investment Advisor and PMS with SEBI.

Appendices

PMS Portfolio* Performance (Net of Fees)

* PMS portfolio is composed of 22 equal weighted stocks. Details of SCP are given below.

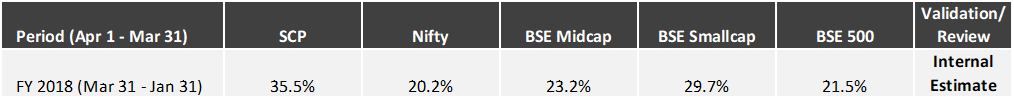

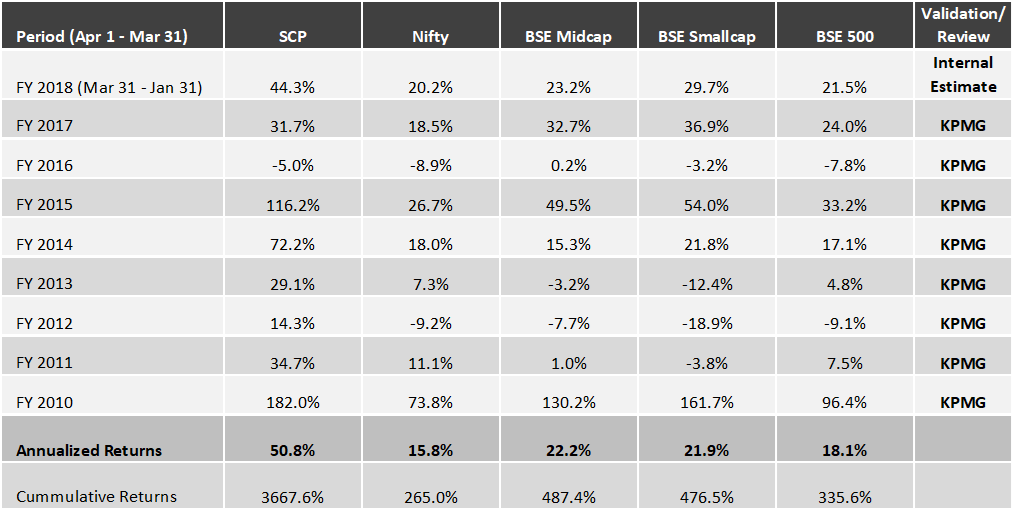

Investment Advisory Core Portfolio Performance (Gross Before Fees)

Below is the gross (pre-fees but excluding dividends) performance of our core portfolio in INR terms for the last 8 years and 10 months. For the first three years we managed proprietary funds and for the last 5 years and 10 months we have been advising external clients. Since clients have joined at various stages, individual performance may differ slightly based on the timing of purchases. For uniformity and ease we measure our performance using a “representative” portfolio (that resembles advice given to clients) and we call it SageOne Core Portfolio (SCP). SageOne core portfolio is not a dummy portfolio but the CIO’s actual total equity portfolio.

8 Years 10 Month Gross Performance in INR (April 2009 – Jan 2018)

* SCP consists of 15 stocks as of Jan 31, 2017. Investment Advisory clients are advised this portfolio.

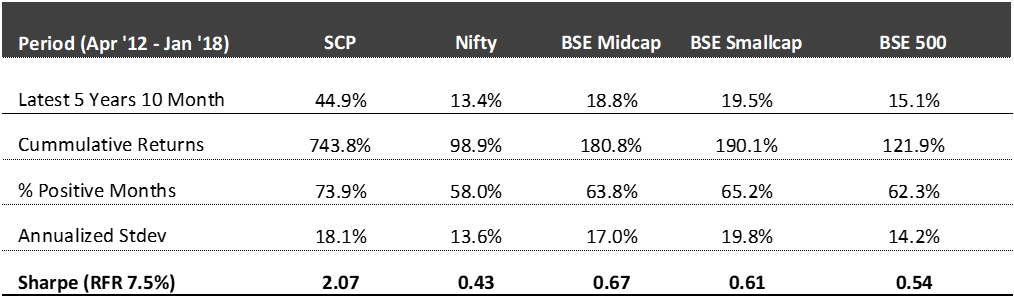

Core Portfolio: Latest 5 Years 10 Month Performance (April 2012 – Jan 2018)

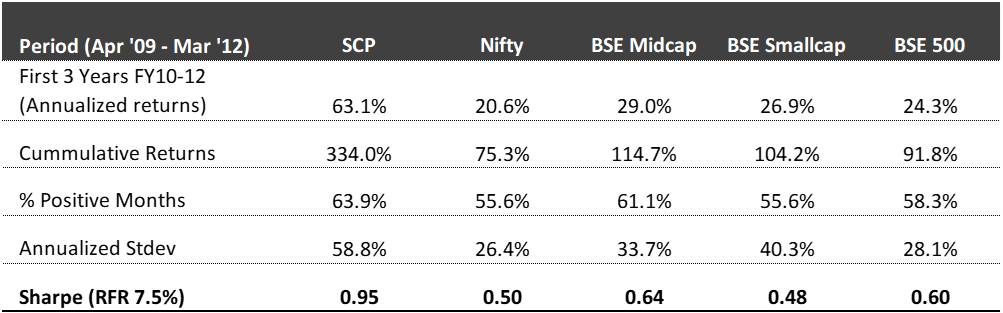

First 3 Years Performance (April 2009 – March 2012)

*We have consciously changed the composition of the core portfolio in terms of the average size of companies and the number of stocks in the portfolio after we started advising external clients in April 2012.

*The weighted average size of stocks at the start in FY10 was below $0.25 bn which has increased to near $1.5 bn by the end of Dec ’17. Also, the number of stocks has increased from 5 (+/- 2) in 2009 to 14 (+/- 2) during the past 5 years and 10 months.

*Reasonable diversification was done by design to improve liquidity and reduce volatility as a result of which annualized standard deviation has come down from 59% for the first 3 years to 18% during the last 5 years and 10 months.

Legal Information and Disclosures

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.