About Us

SageOne Investments is built on deep research, disciplined investing, and a commitment to long-term wealth creation.

About SageOne Investment Managers

Founded in 2012 by Mr. Samit Vartak, SageOne Investment Managers LLP was created with a singular vision: to share his wisdom and knowledge in identifying exceptional businesses with investors. Our name, ‘SageOne,’ reflects our mission. ‘Sage’ symbolizes the wisdom, diligence, and strategic insight that guides every investment decision we make.

Our Approach

At SageOne, our disciplined investment framework SAGE guides us to uncover long-term opportunities. We invest in companies that are:

Sustainable

Focused on responsible operations and sound decision-making that drive lasting impact.

Accountable

Committed to transparency and delivering value to stakeholders.

Growth-Oriented

Built for long-term success with strong fundamentals and market leadership.

Efficient

Optimizing capital allocation and execution for sustainable profitability.

Our Differentiation

At SageOne, we believe investing is not just about numbers—it's about insight, strategy, and foresight. Here's how we stand out:

Deep Dive Research

We go beyond the surface, analyzing companies from leadership to operations, ensuring we invest in businesses with solid foundations and visionary teams.

Long-Term Focus

We target sustained growth, not quick wins, building portfolios designed to thrive over time.

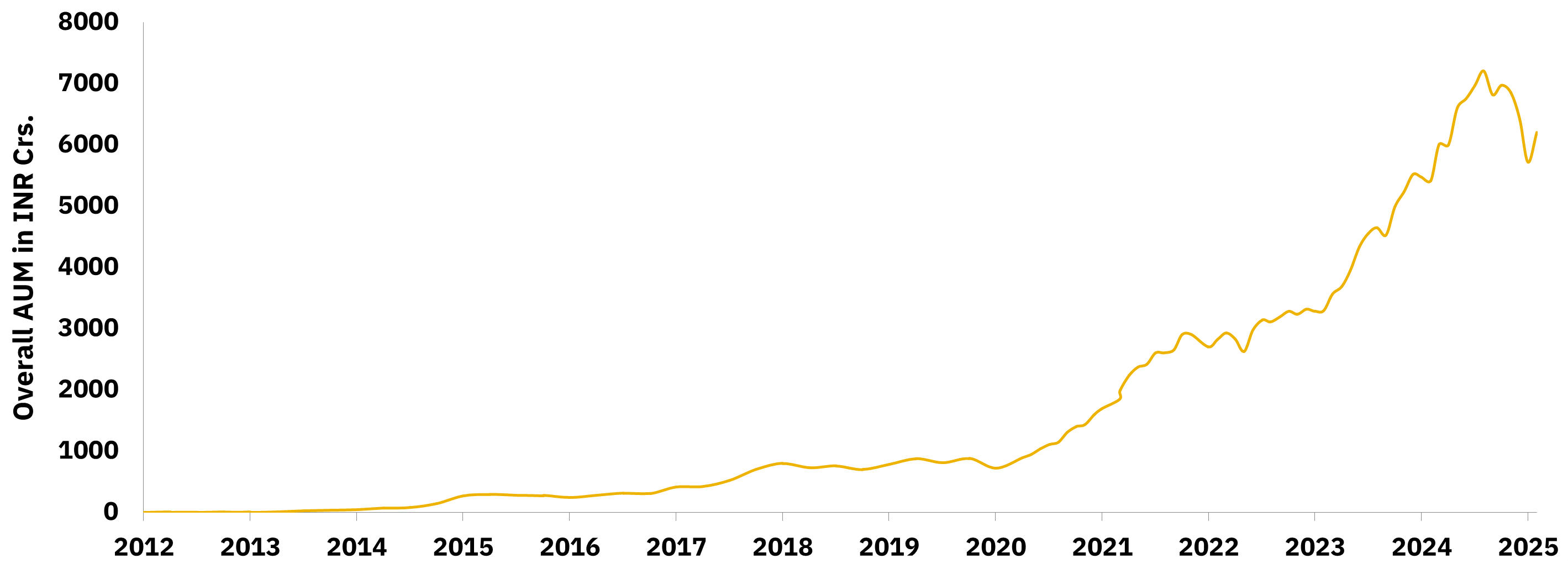

Our Journey Over the Decade

Since 2012, SageOne Investments has grown into a leading investment firm, driven by research, discipline, and a commitment to long-term wealth creation. Our journey reflects continuous innovation, market expertise, and a track record of delivering superior returns.

2012: Established SOIM with SageOne Core Portfolio (SCP)

2014: Became Sub-Advisor to Cayman Island Offshore Fund

2017: Acquired PMS License Late 2017-18: Halted new Fund Inflows due to Valuation Concerns

April 2019: Introduced SageOne Small Cap Portfolio (SSP) August 2019: Launched SageOne's First CAT III AIF Scheme

Jun - Aug 2021: Returned AIF Scheme 1 funds with >100% Returns in 2.5 yrs; Launched AIF Scheme 2

December 2022: Halted new Fund Inflows in SSP due to Size Constraints

August 2023: Launched SageOne Large & Midcap Portfolio (SLMP)

August 2024: Launched AIF Scheme 3 (Open-Ended)

January 2025: Launched SageOne India Growth GIFT Fund; Opened SSP for New Fund Raise after 2 yrs

Established SOIM with SageOne Core Portfolio (SCP)

Became Sub-Advisor to Cayman Island Offshore Fund

Acquired PMS License

Halted new Fund Inflows due to Valuation Concerns

Introduced SageOne Small Cap Portfolio (SSP)

Launched SageOne's First CAT III AIF Scheme

Returned AIF Scheme 1 funds with >100% Returns in 2.5 yrs; Launched AIF Scheme 2

Halted new Fund Inflows in SSP due to Size Constraints

Launched SageOne Large & Midcap Portfolio (SLMP)

Launched AIF Scheme 3 (Open-Ended)

Launched SageOne India Growth GIFT Fund; Opened SSP for New Fund Raise after 2 yrs

Our Achievements

Our commitment to disciplined investing and high-conviction strategies has earned industry recognition. SageOne Investments continues to deliver superior risk-adjusted returns, setting benchmarks in portfolio management.