Decoding DCF Valuation

Dear Investors,

We are happy to share our new note as part of our Knowledge Series initiative on “The Concept of Discounted Cash Flows”. This is our second note for the year 2023, while in our previous note, my colleague Kshitij Kaji had beautifully penned down his thoughts on ‘Spirituality & Equity Investing’.

The Concept of Discounted Cash Flows (DCF)

There are several types of valuation methods used to determine value of an asset, a company or an investment. The most commonly used methods are comparable company analysis using valuation metrices like P/E, P/B and EV/Ebitda ratios, dividend discount model, discounted cash flow analysis, Net asset value, etc. In this note, we shall look at the concept of ‘Discounted Cash Flows’.

DCF is a method of valuing the expected future cash flows of a business, project or asset using the time value of money. The idea behind the DCF method is that the value of an asset today is the sum of all its expected future cash flows, discounted back to the present at a given discount rate.

DCF is often compared with the initial investment. If the DCF is greater than present cost, the investment is profitable. The higher the DCF, the greater return the investment generates. If the DCF is lower than present cost, investors should rather avoid the investment and hold cash.

To perform DCF, the first step is to forecast the expected future cash flows of an investment for a specific time-period, as well as the terminal value of the investment. The estimated time- period can be the investment horizon. Then, one needs to estimate the appropriate discount rate to be applied future cash flows to determine the present value.

Lastly, use the DCF formula to calculate the present value of those future cash flows. The formula for discounted cash flow is as follows –

DCF = CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 +……+ CFn/(1+r)^n

Where:

- CF1, CF2, CF3,…., CFn = expected future cash flows every year

- r = the discount rate

- n = number of periods over which the cash flows are expected to occur (often its number of years)

What is Discount Rate??

The discount rate is the key factor in DCF method of valuing an asset or investment. It reflects the time value of money, as well as the risk associated with expected future cash flows.

The time value of money refers to the idea that a dollar received in the future is worth less than a dollar received today, because the dollar received in the future can potentially be invested and earn a return.

In general, a higher discount rate will result in a lower present value, as it reflects a greater level of uncertainty or risk associated with expected future cash flows.

The discount rate can be determined in a variety of ways, depending on specific circumstances of the asset/investment being valued. Some common methods for determining discount rate include:

For an investor while evaluating required rate of return from a stock/investment

→ The risk-free rate (rf) – the rate of return that can be earned on a completely risk-free investment, like the GSec Yield or US Treasury Bond Yield.

→ Risk Premium – Incremental rate of return over and above rf that an investor expects to receive for taking on a certain level of risk in an investment

For a company while evaluating a project

→ The weighted average cost of capital (WACC) – this is a measure of average cost of capital for a company, considering the cost of equity and cost of debt.

It is important to carefully consider the assumptions being made for discount rate as it can have an impact on the final value of the asset/investment.

Let’s understand the concept of DCF with a couple of examples –

Example 1:

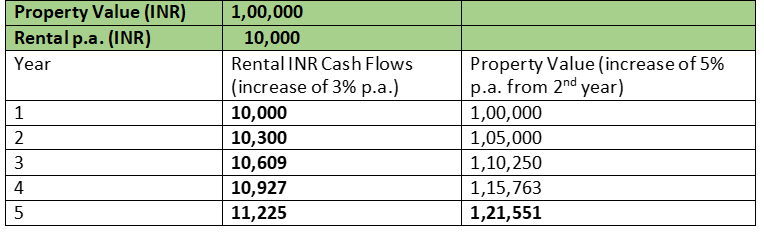

Suppose you are considering purchasing a rental property for worth 1,00,00 for 5 years. You expect the property to generate annual rental income of INR 10,000 in the first year and expect it to increase by 3% per year. You also expect the property to appreciate by 5% per year from second year. You decide to use a discount rate (i.e. an alternative rate of return investment opportunity) of 10%.

To determine the present value of future cash flows using DCF, we need the following

- Forecast expected future cash flows – based on our assumptions the expected annual cashflow for the first 5 years would be:

- Calculate the present value of rental cash flows using DCF Formula –

- DCF= 10,000/(1+0.1)^1 + 10,300/(1+0.1)^2 + 10,609/(1+0.1)^3 + 10,927/(1+0.1)^4 + 11,255/(1+0.1)^5

- = INR 40,007

- Calculate the present value property using DCF Formula –

- DCF = 1,21,551/[(1+0.1)^5]

- = INR 75,473

- Adding the present value of rental cash flows and present value of appreciation, i.e.

- Total present value = INR 40,007 + INR 75,473 = INR 1,15,473

So based on our property assumptions (yearly rentals and property appreciation) and discount rate of 10%, the present value of the property is INR 1,15,473 which is more than your initial outlay of INR 1,00,000 thereby making it a favourable investment opportunity for you. However, for the same property, if you increase the discount rate (i.e. an alternative rate of return investment opportunity) from 10% to 15% and maintain the same property assumptions, the present value of the property is INR 95,270 thereby making it an unfavourable investment opportunity for you since the value is less than your initial outlay of INR 1,00,000. Therefore, you would need to consider an investment based on your risk tolerance and investment goals.

Example 2:

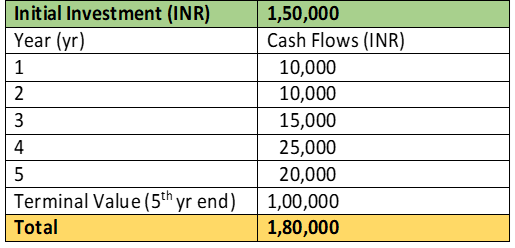

A company requires initial investment of INR 1,50,000 for a project to generate cash flows for the next 5 years. The project will generate INR 10,000 for the first two years; INR 15,000 in third year; INR 25,000 in the fourth year and INR 20,000 in the fifth year with a terminal value of INR 1,00,000 in the fifth year. We assume cost of capital of 12%.

- Calculate the present value of cash flows using DCF Formula –

- DCF = 10,000/(1+0.12)^1 + 10,000/(1+0.12)^2 + 15,000/(1+0.12)^3 + 25,000/(1+0.12)^4 + 1,20,000/(1+0.12)^5

- = INR 1,11,557

Without considering the time value of money, this project will create a total cash return of INR 1,80,000 after five years which is higher than the initial investment and thus seems profitable. However, after discounting the cash flows for each year, the present value is only INR 1,11,557 which is lower than the initial investment for the project. This suggest that the company should not invest in the project.

What are the potential Pros and Cons of DCF method??

Pros:

→ Considers time value of money: DCF method considers the fact that money today is worth more than the same amount of money in the future, due to opportunity cost of not being able to invest it.

→ Incorporates cash flows: DCF explicitly considers the cash flows that an investment will generate, rather than just looking at the initial investment or the final value.

→ Customizable: DCF can be tailored to an individual investors’ desired rate of return, making it useful for comparing investments with different risk profiles.

Cons:

→ Requires forecasting: DCF relies on accurate forecasting of future cash flows, which can be difficult to do accurately.

→ Sensitive to inputs: the output of DCF analysis can be highly sensitive to the inputs used, such as the discount rate and the projected cash flows.

→ Ignores non-quantifiable factors: DCF only considers quantifiable factors such as cash flows and discount rate and does not take into account intangible factors that may affect the value of an asset/investment.

We, at SageOne, do evaluate an investment, using the DCF method for certain sectors where there is better predictability of future cash flows, such as the Real Estate sector. DCF is mostly complemented with other parameters of valuation to decide on any particular investment.

It is important to note here that since SageOne as a fund house follows a growth strategy, our discount rate to evaluate a company/investment would be much higher (generally 18% to 25%) while performing DCF analysis which determines the valuation at which we would invest in a particular company. Discount rate varies from investor to investor depending on their expected return from a particular stock. Samit in one of his memos had beautifully deciphered on DCF, mentioning how valuation multiples change based on one’s expected return i.e. altering the discount rate (SageOne Investor Memo Aug2020).

I hope our investors would now have some better understanding of the concept of DCF and that this note was useful and that you enjoyed reading it as much as we enjoyed compiling for you.

Warm Regards,

Parin Gala

Vice President – Research

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.