Importance of Process in Investing

Dear Investors,

I am happy to share a fresh Knowledge Series note on “The Importance of Process in Investing.” In our previous knowledge series, my colleague Parin Gala, had deciphered the Concept of Discounted Cashflow in an extremely simplified manner.

Introduction

In my investment career of ~9 years, I have had the privilege of meeting some of the greatest investors in our country. A few years ago, I had the opportunity of attending a program conducted by the Flame University – “Investment Lab with the Masters,” where the most popular and successful equity investment managers share their thoughts on investing. I have also had the opportunity of attending various CFA events over the years and heard multiple fund managers discuss their investing style. I have also had the privilege and pleasure of working with Samit Vartak (our Founder and CIO) for the last 2.5 years. When I sit back and think about the common thread that plays a crucial role for all these great investment managers and their eventual success, it is HAVING A “PROCESS” IN INVESTING.

Definition of Process in terms of equity investing

Process is defined as a series of actions or steps taken to achieve a particular result or objective. In equity investing, there is only one end objective which is to generate higher returns over long periods with reduced volatility (as described by the Sharpe/Sortino ratios). According to Professor Sanjay Bakshi, another way of defining the objective of equity investing is to “measure returns per unit of stress.” To achieve success and reach the end objective, the focus should be on the process and not the outcome. If the process is full proof, the outcome will be rewarding.

Is there anything such as a correct Process?

In my stint so far with the equity research and investment industry, I have come across various market participants, each having different processes, and having a strong belief in their process. The presence and application of these different processes ensures that the market breadth is always wide as various participants take a fancy to different investing methods and endeavour to outperform during different time frames. However, there is no correct or perfect Process or ‘Holy Grail’ of investing. Life experiences, investing journey experiences and mentors in the initial few years of investing, define an investor’s process and the subsequent journey in investing.

Factors determining an equity investing Process

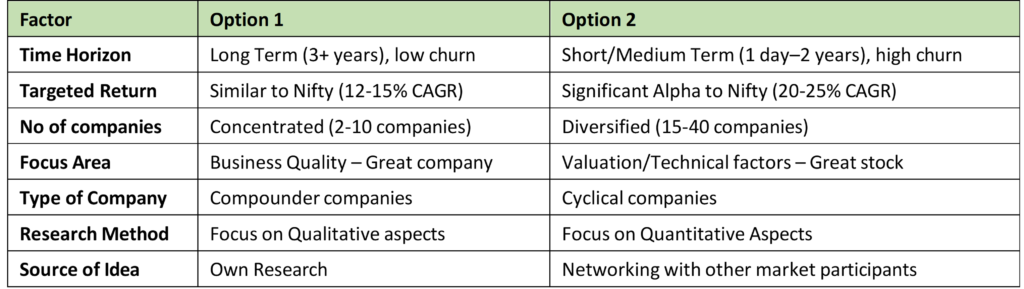

Below are some of the factors one needs to keep in mind when forming a process. For all these factors there are two basic options which an investor can choose from. It is not necessary that all the choices would be from one of the columns. Multiple investors have multiple thought processes where they choose either of these options (or combine both options) for different factors.

Investors picking options for the above factors is an outcome of the time devoted by them in understanding the market and the various experiences during that time. Hence, it is fair to say that creating a Process is a time-consuming experience and also entails multiple costs too.

Cost and timeline of the Process

One can expect a ~10-year gestation period for process creation as it is the time taken to lay down the groundwork, and experience two bull and bear cycles. During this period, it is likely that one will make higher losses in the initial periods. Losses are a cost of running any business and it is no different in equity investing. If one treats equity investing as a mere job and not their passion, they would tend to give up during the early gestation period, rather than putting efforts to refine the process and improve. One should be able to absorb the risk and treat the losses as tuition money. Post this gestation period, there is a hockey stick growth or a J curve in the returns generated. Hence post the initial costs and the time dedicated, the fruits are borne over a long time as indicated below.

An interesting analogy is that of the Chinese bamboo tree. It takes almost 5 years to complete its growth of ~80 feet. Although the height is not unusual, but the way it grows is. After religiously watering the plant every day, it may not break ground for 5 years. After it breaks ground, it grows ~80 feet in just 5 weeks. The roots of the bamboo tree need to be strong for it to grow so tall. Hence it takes over 5 years for the roots to become stronger, which allows the spurt in a short span of time. Equity investing is similar. Most investors look for quick returns based on ‘tips’ by others rather than putting in the effort to understand how it works, creating a Process and learning from their mistakes.

Evolution of the Process

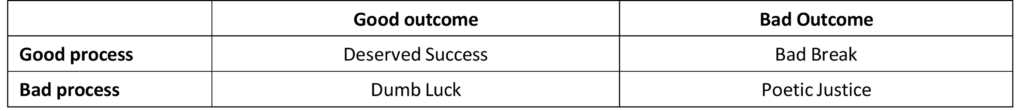

In ‘The Little Book of Behavioural Investing’, James Montier highlights the following matrix:

Based on the above tabulation, initially all investments are based on speculative instincts and ‘tips,’ which if they go well, result in ‘Dumb Luck.’ Most times, ‘Dumb Luck’ results in overconfidence and laziness in creating a process. Daniel Kahneman, in his must-read book ‘Thinking Fast and Slow,’ discusses two modes of thought – System 1 (quick and intuitive) and System 2 (slow and effortful). Most human beings are lazy and try to find the quick and easy way out (System 1).

Investors finding ‘Dumb Luck’ are generally without a process and likely to underperform over the longer term. The simple reason for this is the price paid for not correcting your mistakes due to overconfidence from ‘Dumb Luck.’ One small error of judgement (cognitive error) or in behaviour (greed or fear), can result in a large underperformance. Evolution of a successful investor happens from bad process to good process but the investor needs to endure ‘Poetic Justice’ early on and take efforts to create a good process and eventually reach ‘Deserved Success.’

A simple illustrative table below shows how inspite of outperformance in 4 out of the 5 years, Portfolio 1 has delivered only half the returns of Portfolio 2, due to a big loss suffered in Year 3. Most investors get carried away seeing their gains and do not even map their performance or returns. Financial losses lead to mental stress which can sometimes lead to even more mistakes or greed.

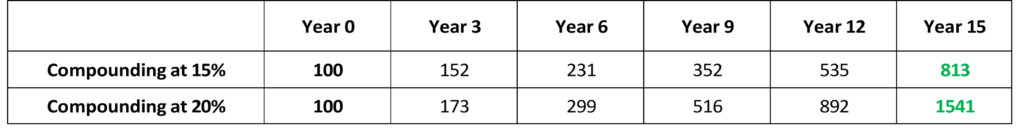

The importance of avoiding mistakes as shown in the above chart, tells us only half the story. Compounding at higher rates over longer periods makes the total returns very stark. This is why compounding is called the 8th wonder of the world. The table below shows 2 portfolios compounding at different rates. Although the difference between the 2 portfolios does not appear large in Year 6, the divergence in returns is almost 2x in Year 15.

Compounding at higher rates over longer periods is possible by having a process that avoids mistakes and entails hard work to create the process and then to follow it. Compounding at 25% p.a. for 10 years gives 10x returns. The human brain is wired to think only linearly or in arithmetic progression (most people would assume 10x returns in 10 years equates to 30x in 30 years). However, compounding follows geometric progression which yields a 1000x return over 30 years when compounding at 25% p.a. Many companies have followed Processes and hence achieved greatness:

Toyota – Deeply entrenched cultural philosophy focusing on improvement by looking for faults in the system/process. Every worker identifies and solves problems to ensure the highest level of efficiency.

Dell – Hyper efficient assembly lines and supply chains with marketing innovation by selling PCs directly to consumers via its website. Carried just 2 hours of inventory in factories and 72 hours inventory in its entire operation.

Amazon – Blends the online world with the real world as efficient logistics see the customer receiving their goods within 24 hours and complex algorithms provide personalized recommendations.

Zara – Most responsive to changing fashion trends. Its designs are a culmination of conversations with product managers and store managers across the globe. The production process and supply chain are highly flexible leading to a rapid response to changing consumer demands in a season.

While we have limited control of our destiny, we do have control on our knowledge, effort, and the way it is channelled. The companies mentioned above, could exercise greater control on their destiny due to their Process. However, figuring out the Process is one thing, but there is an even more important subsequent step.

Implementing the process is more important than setting it up

To achieve the ‘Deserved Success,’ requires rigorous discipline in implementing the process. As investing is more about psychology and behavioural finance, character is key in this turbulent industry.

When Martina Navratilova was asked how she maintained focus, physique, and a sharp game even at the age of 43, she replied by saying – “The ball does not know how old I am. Every game in life is played on a 6-inch ground – the space between your two ears. We do not live in bungalows, duplexes, or flats but in our mind which is an unlimited area. Life is great when things are sorted and uncluttered there. The key factor to performing well in life and in every arena is the ability to control the quality and quantity of your “internal dialogue.” Performance is potential minus internal interference. Live in peace and not in pieces.”

Although one may develop the skill set through the process, one needs temperament to overcome the emotions. Clarity of thought process coupled with control over mind are key. These are achieved through Spirituality, as explained in my earlier note.

Should the process be changed often?

Many successful portfolio managers go through bad patches with a sustained period of underperformance. In such times, they are faced with a barrage of criticism from clients and other participants in the industry. However as described in the earlier table, there are multiple options to choose from when creating a process.

These different options work at different times. When the economy is just coming out of a trough, the best quality companies tend to move first as there is comfort on the business model and the valuations. Soon, due to higher demand, these companies become expensive in valuations. As the economy picks up further steam, multiple sectors and companies start doing well. Companies with average businesses start exhibiting better stock price performance due to improvement in fundamentals and valuations. Quality businesses may underperform as they were already priced to perfection.

Hence certain fund managers may perform better in the earlier phase while others investing in cyclicals may perform better in the latter phase. However, fund managers should not switch strategies based on market movements as their circle of competence is limited to the process, they specialize in. Switching strategies and being successful may entail a higher luck component as it is impossible to know which strategy may work well. However, creating a sustainable process, and sticking to it with discipline is sure to yield favourable results in the long term even without switching the strategy in the short term. One should, however, always learn from their mistakes and keep tweaking or refining their strategy as and when required.

Conclusion

I have always internally debated the rat race involved in generating higher returns and competition between fund managers. I do feel that process is more important than the returns as returns can be very subjective based on the starting point or also on the timeframe selected as various fund managers tend to outperform at different times in the cycle.

I believe even investors should not be short sighted and greedy by focusing on returns but focus on the ‘Process’ when choosing fund managers. It is like studying a company where one does not only focus on high ROCE or high growth, but more on how that business generates such growth or ROCE, and the sustainability of it over a long period of time.

Samit Vartak (our Founder and CIO of SageOne), through his multiple memos over the years, has highlighted SageOne’s process which is linked to the compounding of earnings of various companies. When companies are bought at fair/reasonable valuations, there is a higher chance that the portfolio returns would correlate to the earnings growth of the companies, over a long-time horizon.

At SageOne, we are fortunate to have a diverse research team having different approaches and processes resulting in identifying & investing in many superior businesses (across sectors) which yielded superior portfolio returns in our investment journey since 2012. Therefore, do not follow somebody else’s process but create and develop your own ‘Process’ over your investing journey.

We look forward to hearing your valuable feedback and suggestions on this initiative of ours and on our part, we shall continue to take up interesting topics to help educate you further and in turn learning from you via your feedback. We hope you enjoyed reading this article.

Warm Regards,

Kshitij Kaji,

Senior Research Analyst

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.