Knowing & Evaluating the Management of a Company

Dear Investors,

Hope you are enjoying reading our ‘Knowledge Series’ initiative. Our previous editions have attempted to decipher in the areas of quantitative (financial) analysis, qualitative analysis or sectoral/new development analysis. This edition is in continuation of my 2nd edition of knowledge series which encapsulated qualitative aspects of analysing a company, where I had summarised on how do we evaluate the promoters from the minorities’ point of view. Here, I would like to talk about the second stakeholders of the company, i.e., the Management and how do we analyse them, if they are par, sub-par or excellent fit to run the business.

Before we analyse on how to evaluate management of the company, we should first know whom we are talking about when we use the term Management. According to us, they are Executive Directors, Managing Directors, CEO, COO, CFO and other top-level managers (also referred as professionals in this note) of the company who are entrusted with setting the vision of the Promoters and Board of Directors of the company in motion, its smooth and efficient execution. Thus, the day-to-day operations and nuances of the company is handled by the management of the company.

Management of the business can be further bifurcated into

a) Promoter driven management; and

b) Professional driven management.

Both of these sub-categories have their own positives and negatives. At the same time, qualitative evaluation of these sub categories is always subjective. Therefore, outcome of the evaluation will always vary on case-to-case basis. However, a deep dive into the discussion is warranted to understand our thought around analysing them.

In India, majority of the businesses are run by the owners of the businesses rather than a full-time external professional. A newly incorporated business would always have a promoter as the show runner of the business. After the first promoter’s retirement, the next CEO of the company could be from the family or a professional (brought from outside or an existing employee being promoted as CEO / MD of the company) would depend on two factors –

→ Promoter awareness of the capability of next generation in promoter family to run the business; and

→ shareholding of the business where investors (VC Funds, PE Funds, Public Market Funds, etc) holding stake more than the promoters have say in the appointment of MD and CEO of the company.

We would like investors to note that from secondary market, the minority investors have limited say in the company unless they can come together and collectively form a meaningful percentage of voting rights as we are seeing in the case of Zee Entertainment currently.

Alternatively, the following scenarios could also be possible:

a) New-age startup companies where growth and increasing market share is upmost priority and the promoter of such companies at early age comes in terms to the fact that they can’t execute everything by themselves and they need a professional CEO / MD to do the execution. Their decision is also dependent on their fund raising;

b) Scenario where the business is incorporated by a professional turned entrepreneur backed by Private Equity firms (PE firms) where the stake of the professional turned entrepreneur would be less as compared to the other PE firms (non-promoter investors). In such cases, the next CEO is mostly a professional where selection is completely based on merit as we have seen in US based companies like Twitter, WeWork, etc and Indian based companies like Sona BLW Precision Forgings, etc.

For SageOne portfolio companies in actively managed schemes, ~75% of the companies are promoter-driven managed whereas ~25% of the companies have professionals leading the show.

In India, promoters do understand the need for a professional management as and when the business size increases, where delegation and a formidable organisational structure plays a vital role before getting set on the growth path. However, they also try to impose their overbearing control on the CEO they hire. This is unfortunately contradictory and should not be encouraged. A professional will always look at the interest of all the stakeholders – the environment, the employees, the suppliers, the customers, rather than taking care of the exclusive interest of just the promoters. That is where the conflict arises.

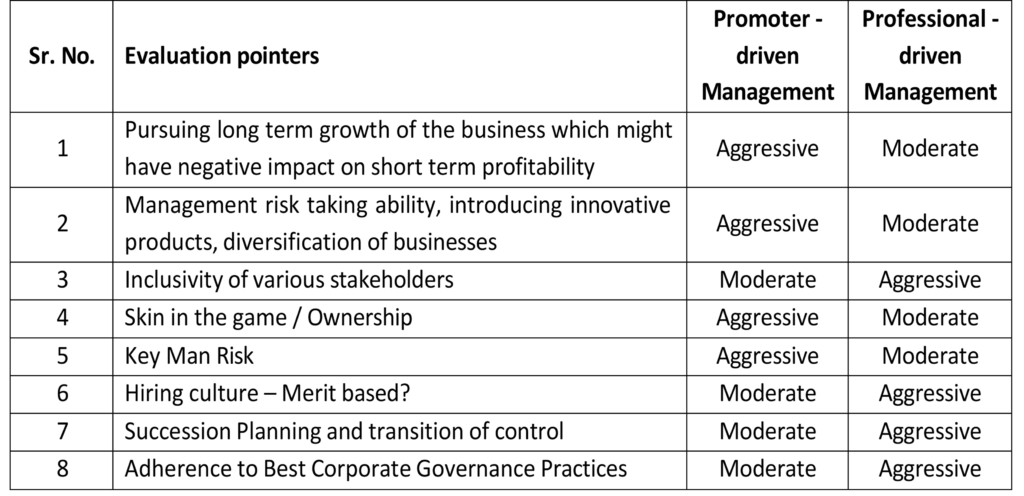

In some evaluation parameters, generally professional run companies would fare well whereas in some parameters, generally promoter-run companies would fare well. Let us understand the same in detail.

1. Pursuing long term growth of the business which might have negative impact on short term profitability

Generally, a promoter-driven management is more aggressive than a professional-driven management. Since, professional CEOs salary and compensations are dependent on the annual profits of the company and they don’t have material ownership in the company, they are hesitant to pursuit such business plans which may have impact on the short-term profitability. Such approach might lead to stagnation in the business where existing profit is good but there is no growth in the business.

2. Management risk taking ability, introducing innovative products, diversification of businesses

Promoter-Managed Companies: Promoters may have a strong entrepreneurial spirit, fostering a culture of innovation, or may be more inclined to explore new business opportunities. Their personal involvement in the company’s history and operations can facilitate quick decision-making and implementation of new ideas. However, Risk-taking decisions may be more subjective and emotionally driven.

For example: In 2018, when Deepak Nitrite was in middle of capex schedule to implement project of diversifying their product category and enter the business of Phenol and Acetone, it was completely new a chemical value chain for them. Despite the category they were entering was import substitution, initially there was resistance from the investors on their capability to ensure smooth execution of the project. But once the promoters exhibited their successful execution through enhanced capacity utilisation of these products, investors started respecting the company and its owner more.

Professionally-Managed Companies: Resistance to change or lack of alignment with the founder’s changing vision or limited external perspective may hinder the adoption of innovative practices. However, an efficient Professional managers may bring diverse industry experiences and a focus on market trends. Their approach may involve thorough market research, feasibility studies, and collaboration with experts to introduce innovative products.

3. Inclusivity of various stakeholders

Promoter-Managed Companies: The management style in promoter-managed companies often reflects the vision, values, and leadership style of the founders. Decision-making may be centralized, and the founders may play a hands-on role in the company’s operations.

Professionally-Managed Companies: In professionally-managed companies, decision-making is typically more decentralized. Professional managers, who may not be the original founders, are hired to run the day-to-day operations, and strategic decisions are often made collectively by a diverse management team.

4. Skin in the game / Ownership

Promoter-Managed Companies: In these companies, the founders or promoters typically have a significant ownership stake. They may have started the business and continue to hold a substantial portion of the company’s shares, giving them significant control and influence over strategic decisions.

Professionally-Managed Companies: In contrast, professionally-managed companies may have a diverse ownership structure with ownership distributed among various shareholders, including institutional investors and the public. The founders or original promoters may still hold shares, but their control might be diluted.

5. Key Man Risk

Promoter-managed companies often have a high concentration of decision-making power and influence in the hands of the founder or key promoters. If the promoter is a visionary leader, the company’s success may be closely tied to their abilities. The risk is higher if there is inadequate succession planning. If the founder has not groomed a capable successor or if the organization is heavily reliant on the founder’s skills, sudden changes may disrupt the business.

The departure of a key man may lead to a shift in corporate culture, affecting employee morale and stakeholder confidence. Implementing talent development programs and fostering a culture of internal promotions can reduce dependency on individual professionals. This ensures that there is a pool of capable individuals ready to step into leadership roles.

6. Hiring culture – Merit based?

In Promoter-Managed Companies, hiring decisions may be influenced by personal connections and loyalty to the promoter or founder. If hiring is not merit based then Promoter might find himself surrounded with bunch of “Yes” men who doesn’t give differentiate view or their perspective on a discussion.

Whereas in Professionally-Managed companies, there may be a greater openness to hiring external talent to bring fresh perspectives and diverse skills to the organization. Professional managers may prioritize attracting individuals with specific expertise and experiences.

7. Succession Planning and transition of control

Promoter-Managed Companies: Succession planning can be a critical issue in promoter- managed companies, as passing control from the founders to the next generation or external leaders may pose challenges. Succession plans may involve grooming family members or selecting external professionals to take over leadership roles.

Professionally-Managed Companies: Succession planning in professionally-managed companies is often more structured, with boards and management teams having processes in place to ensure a smooth transition when key executives depart.

8. Adherence to Best Corporate Governance Practices

Promoter-Managed Companies: Corporate governance structures in promoter-managed companies may vary, and there is a potential for conflicts of interest due to the close association of promoters with the company.

Professionally-Managed Companies: These companies often emphasize strong corporate governance practices, with boards of directors providing oversight, ensuring transparency, and representing the interests of diverse shareholders. Ensuring best practices rather than cutting corners are more focused, the practices could be accounting, auditing, compliances, environment impact assessments, sustainability, etc.

FACTORS WE LOOK IN A PROMOTER MANAGED COMPANY –

a) Promoter’s education: Whether the education of the promoter or the family member to whom baton has been passed have relevant education? We have seen cases where children of the promoter who have degree and passion in IT engineering are part of the board or senior management team of a laminate company or a chemical company. Such miss fit either results in sub-par business performance from the vertical such promoter member is heading or else it results in company getting into completely unrelated business just for the satisfaction of such promoter member.

b) Promoter’s work experience: Education is not the only criteria; we have seen many promoters who don’t have fancy degrees but just because of their extensive work experience in related businesses/companies have given them detailed understanding of the business.

→ We had come across a case very recent where promoter made his daughter the MD of the company where she had no relevant education and work experience, and because of the series of bad decision taken during critical times like Covid-19, the promoter had no option but to sell his entire company to its competition because of irreparable operational performance.

c) Promoter’s track record as middle-level manager: Before being appointed as the Managing Director of CEO of the company, whether the promoter member has handled any verticals of the company as a middle-level manager and how did he performed in the roles which were entrusted to the promoter member. There are many companies where we have seen trajectory of the growth and business strategy changing after the affairs of the company was passed from one generation to another generation of same promoter family because of the sheer capability of the new MD/CEO.

→ We have seen in case of Borosil group, where after Shreevar Kheruka coming in the driver seat has steered the group to better position based on his fresh vision to focus more on branding and marketing.

d) Speaking to promoter’s ecosystem: We can get a good understanding on mental strength and the business acumen of a promoter from people surrounding him. These could be from friends, relatives, employees, ex-employees, professionals rendering services to promoter, etc. Their feedback can help in judging if the promoter is a good fit to take the company to a better position, or it would have been better if professional CEO would be kept in commanding seat.

→ For example: Before investing in APL Apollo in 2017, while doing check on Sanjay Gupta, promoter of the company, we came to know the respect he commands in the industry. Over the years, Mr. Gupta has exhibited his execution capability to not only propel growth in organic way but to also add categories to the industry and expand the total addressable market size of the company.

e) Promoter’s focus on institutionalizing the company: It is important for founder/promoter to be self-aware of what is best for the company. Most of the family-run businesses don’t continue beyond 3 generations unless there is a proper merit-based framework set around for selection of baton holder. Promoter should always ask themselves, is it the right time to be making a change in leadership? What does the business require to move forward? Is the new promoter member capable enough or some other non-promoter is better suited? How will I manage this transition? Am I ready to relinquish control and allow someone new to lead the company?

→ A Bajaj Finance, a leading BFSI company is a classic example to this, where the business was been run by a promoter CEO however, in 2007 a professional CEO was bought to run the company and it changed the fortune of the promoter.

f) Promoter’s ownership: If promoter has ownership of less than 30-35% in a promoter led company (except BFSI where capital is main raw material and the company constantly have to raise funds to support high growth), there is a possibility that lucrative business opportunity which promoter comes across is established in a sister concern where promoter would have 100% ownership of the business rather than the listed entity where he has 30-35% stake. The chances of the same happening in professionally managed company is less as he is more concerned with the company where he is CEO instead of maximizing the personal wealth of promoters at the cost of minority investors.

→ Once we came across a company which is into e-waste recycling, where the promoter had less than 30% stake in the company and they were guiding to start a business in the listed company where the return on equity of the business was upwards of 80%. My thought was: If the new business was so lucrative then why would the promoter want to be just 30% owner of such business by doing it in listed entity and why not float an unlisted entity where promoter is owning 100%? Nothing has happened in this company since then and the market cap has been eroded by more than 80% since that meeting.

FACTORS WE LOOK IN A PROFESSIONAL MANAGED COMPANY –

a) Professional’s work experience and track record: Evaluate the professional’s experience within the relevant industry. Familiarity with industry dynamics, challenges, and opportunities is crucial. Assessing the previous roles of the individual’s track record in leadership roles, including any notable achievements, successful strategies, or turnarounds.

b) Verifying financial acumen of an industry expert: It is not necessary that a professional who is an authority in the subject/field in which the company operates in have a prudent financial discipline as well. Thus, it is important to verify the professional’s understanding of financial metrics, budgeting, and capital allocation. Assessing the professional’s ability to create shareholder value through financial performance and strategic initiatives.

c) Professional’s adaptability and risk management: Evaluating the professional’s ability to adapt to changes in the business environment and industry trends; assessing his ability to identify potential risks to the business and implement effective risk mitigation strategies; evaluating how the professional manages crises or unexpected challenges.

d) Personal reputation and integrity: We should check the professional’s reputation within the industry and business community. It is important to assess the professional’s personal and professional integrity by speaking to people known to the professional – ex-colleagues ins of previous organizations, previous seniors and team members.

→ We have witnessed many companies becoming multi-baggers where there has been transition from promoter management to professional management or a change in CEO from one professional to another professional.

e) Whether professional’s salary structure including ESOPs is in sync with the industry standards: Professional’s salary should be adequate for them to perform and execute their duty. If their compensation is inadequate, then a proper ESOP policy should be encouraged such that they can get some ownership of the company and therefore a vested interest to enhance the market capitalization of the company by improving operational performance. Sometimes, promoters tend to appoint professionals for name-sake for creating a false perception of institutionalizing the company in the eyes of investors. We should be aware of such promoters and companies as professionals are not given a free hand to do their work independently.

→ Companies following best corporate governance practices, enlists details of Top 10 employees in terms of remuneration drawn during the year as per Rule 5 of Chapter XIII, the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014. We have come across cases where CFO and CS of Rs 2000 crs market cap company has annual salary significantly less than the industry average.

Conducting a thorough due diligence on the management is essential for investors to gain confidence in the leadership’s ability to steer the company toward sustainable growth and success. This evaluation should include a combination of quantitative metrics, qualitative assessments, and an understanding of the CEO/MD’s strategic vision for the company. And yes, this is a continuous process and the quality also changes when we regress the same with changing business cycles, scale of the business, competition landscape, technological changes, etc.

We at SageOne aspire to help our readers relate/understand the investment philosophy and approach we follow at SageOne. In this note, we have attempted to enlist some of the most intricating points revolving around management of the company. We hope you enjoyed reading our compilation as much as we enjoyed putting it together.

Best Regards,

Pratik Singhania, CFA, CA

Vice President – Research

SageOne Investment Managers LLP

Pratik was recently awarded under “40 Under 40 Alternative Investment Professionals in India” for the year 2024 by Equalifi (erstwhile AIWMI) (https://equalifi.org/about-us/). Equalifi’s “40 Under 40- Alternative Investment Professionals in India” campaign now in its seventh year is the most prestigious awards campaign for the alternative investments industry. This initiative has been designed to identify the best and the brightest minds in the Indian alternative investments sector. (https://equalifi.org/40under40aip-2024/)

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.