Perspective on “Financial Shenanigans” along with case studies

Dear Investors,

We at SageOne are happy to share our second note for our Knowledge Series initiative. In the first note, Parin Gala attempted to decipher the concept of ‘Cash Flow Adequacy’ and its larger importance compared to revenues and profits reported in the P&L Account of companies. In this note, we have tried to explain and share ways in which earnings can be manipulated by corporates primarily via Revenues. They are known as ‘Financial Shenanigans’.

Demystifying the concept of Financial Shenanigans

Financial Shenanigans can be summarized as the art of fooling investors by falsely stating the financial statements. While it is the auditor’s responsibility to prevent such practices from occurring, however, it is important to understand their incentive structure. Auditors are paid by the company for their services and due to such incentives, certain irregularities might be passed off as immaterial by the auditor. In certain cases where auditors highlight certain questionable accounting practices, punitive actions are rarely taken, and most investors do not go through the intricacies of the statements to understand the impact of such irregularities. Financial Shenanigans must be taken seriously as the shock of such scams is tremendous, and a single case of fraud has the ability to negate the returns of all the other stocks in portfolio.

This report will highlight few common examples of financial shenanigans as observed in the Indian market. Some of the companies discussed have been held accountable for their behavior while some have not. However, it is our belief that regardless of the outcome, financial manipulation is fundamentally wrong. At SageOne, as part of our investment process, our team dedicates substantial bandwidth in segregating such companies from our investable universe.

The Context for the Crime

First, it is imperative to understand the cause for fraud. While it could be easily said that greed causes fraud, the answer is not so simple. Through detailed research by multiple people and organizations, certain common traits are visible across the spectrum of companies that have engaged in fraud. While this system cannot find each and every instance of fraud, it would definitely reduce an investor’s chances of being defrauded by a wide margin.

While assessing a company that has a potential investment opportunity, one must answer the below 4 questions to gauge the probability of fraudulent behavior: (1) Do appropriate checks and balances exist among senior executives to snuff out corporate misdeeds? (2) Do independent members of the board play a meaningful role in protecting investors from greedy, misguided, or incompetent management? (3) Do the auditors possess the independence, knowledge, and determination to protect investors when management acts inappropriately? and (4) has the company improperly taken circuitous steps to avoid regulatory scrutiny?

The answer to the first question lies in the management culture of the organization. A meritocratic system allows for free communication between members of the management team and allows healthy argumentation which keeps members in check, which is important in any organization. An autocratic or dictatorial management system, on the other hand, does not leave room for dissent, allowing the behavior of top officers to go unchecked. If the management is fearful of the owners and does not have the right financial incentives, fraudulent behavior would remain unchecked. If the management is extremely aggressive at achieving and promoting targets, and somehow almost always achieves them, it should lead to a moment of caution rather than celebration. An inquiry into the nature of such growth is imminent. Prudent management that outperforms is much more valuable than aggressive management that meets their targets.

Investors must additionally understand the nature of board membership and inquire into the nature of independence of the board. Board members that act as ‘yes men’ to the Chief Executive Officer or Chairman are of little help to the minority investors. The duty of the board is to safeguard the interest of all investors and must ensure that the best practices are followed by the company. A board that is filled by family members and close friends who contribute little and receive large compensation packages is detrimental for the minority investors and said investors must be wary of such board.

Checks and balances can also be maintained through auditors, who should ensure that the correct accounting practices are maintained, and questionable ones are highlighted for the benefit of investors. However, this is a checking method as a method of last resort has not been fruitful for multiple reasons. The auditors are paid by the company, which means that the auditor would tend to give a favourable opinion in order to generate more business. This is particularly true in the case of small auditing firms who might let the actions of an anchor client go unnoticed due to the large percentage of revenue generated by such a corporation for the auditor. This is similar to the problem of rating agencies being paid by the corporations to give them higher credit ratings. This example, was a key factor that led to the 2008 Financial Crisis.

Type of Financial Shenanigans?

- Earnings Manipulation: Report Net Income much higher than it actually is.

- Cash Flow: Report cash flows that have not been received

- Acquisition Accounting: Acquire something at a price, justifying the purchase.

- Key Metric: Change certain metrices to make the valuations look good.

In this note, we would focus on Earnings Manipulation

Earnings Manipulation

Earnings can be manipulated by managing changes in revenue and expenses in P&L Account. The companies can Inflate either current or future period earnings.

Revenue:

Most common way to manipulate is to increase/decrease intake of revenues. Easiest way is to book revenues too soon or push revenues to a later period or record completely bogus revenues.

Companies must record revenues when earned and not just when money is received or contract signed.

Increase in Receivables:

Receivable (debtors) is a good metric to gauge for any manipulation. If a company reports very high growth in revenues but that is not back by cashflows and the receivables are going up proportionately, investor should look into with more granularity.

Likewise, one can look at receivable days of a company and check the trend for the past few years. Any increase in receivable days indicates that company is offering extra credit period or is inefficient in collection. Receivables as percentage of sales helps identify what portion of sales is on credit.

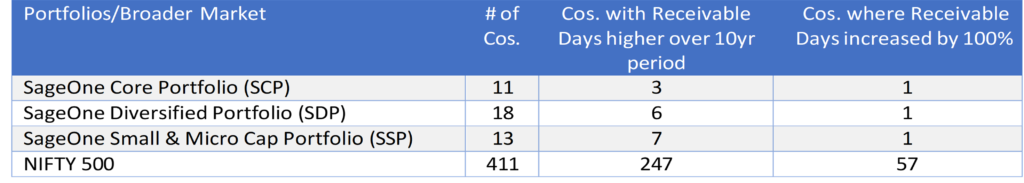

Below the table of Nifty 500 (Broader Market) companies, compared with SageOne Portfolio companies, to see how the portfolio companies have fared on the receivable days front. For our analysis, we have considered data as of FY20 and we have excluded financial companies:

Source: ACE Equity

With regards to SageOne Portfolios, we see a slightly higher number of companies with increased receivable days for our SSP. This is understandable to an extent since most of them are in the small and microcap category. This number shall improve as these companies continue to grow in size. We have surely been watchful. The one stock which appears in the third column for increased receivables by 100%, is from the fertilizer space where the company is dependent on govt subsidies and there is usually a delay in receipt of the same. The company is de-risking itself in the process and good portion of this subsidy dues from the government will be realised in next 3-6 months.

Across SageOne portfolio companies, our key performance metrics of market share dominance & leadership, balance sheet strength, superior earnings growth, management’s prudence, etc. have remained intact or have become all the more strong or attractive.

Thus, the above analysis gives us some idea of where the companies stand with regards to their collection. We thereafter have to dig in to the industry and company specific factors to determine why exactly the receivable days gone up enabling us to conclude if the adverse increase in receivable days is temporary/exceptional or structural in nature.

Other ways to boost Earnings:

- Boosting income using One-time or Unsustainable activities

- Keeping books open for an extended time period. For example, a company sells its products till 35 days and reports as 30 day or monthly sales.

- Shifting of current expenses to a later period

- Checking magnitude of Related Party transactions

Case Studies: A Reality Check

- A Computer Hardware & Office Solutions MNC – Classic case of reporting bogus revenues

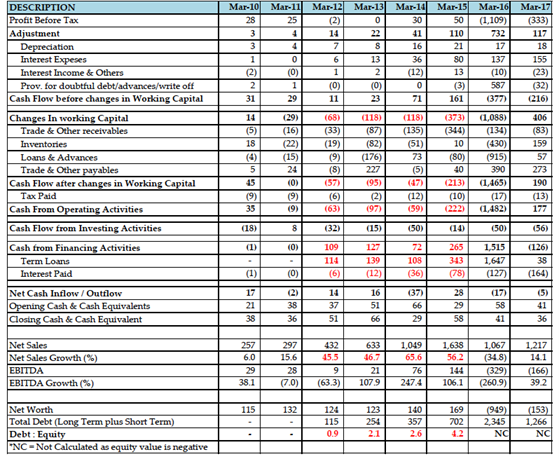

During FY11-15, the listed Indian subsidiary reported sales growth at 53% CAGR. The management claimed that the company’s focus on digitizing documents and implementing paperless, efficient processes for various companies was leading to supernormal sales growth.

However, along with growth in sales, company’s working capital (debt) too had ballooned. Its working capital days increased to 180 days on incremental sales. Company reported cumulative EBITDA of INR 250cr while its cash flow was negative INR 410cr. This is a classic case of reporting bogus revenues.

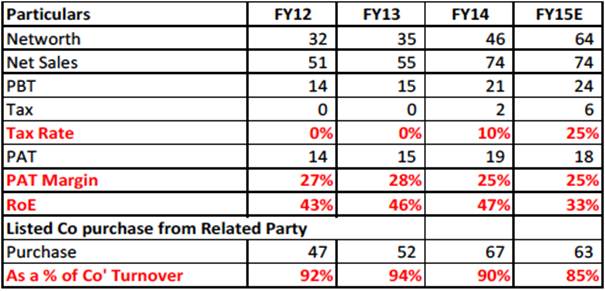

2. A Listed Footwear Company – Case of jugglery through related party transactions

The company is one of the largest exporters of finished leather in India. The company has also diversified into manufacturing of shoes.

Amalgamation of a related party entity at valuation unfair to minority shareholders: A related party entity, engaged in manufacture of leather footwear, was owned by promoters of company in their individual capacity. The related entity enjoyed higher margins of 35% for limited time period compared with 16% on sustainable basis as its manufacturing was located in tax free zone. The related entity was amalgamated with the company in 2016 just prior to these tax benefits going away resulting in increase of promoter stake from 66% to 74%.

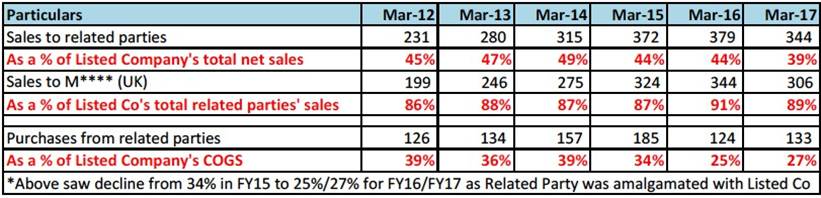

Related Party Entity

High proportion of sales and purchase came from related party transactions, raising serious concern on promoter integrity as well as genuineness of reported numbers.

Listed Company

Sales to related party formed 45% of listed company’s sales over FY12-17. Of the sales to related parties, M**** (UK), a company owned by the promoters in their personal capacity, accounted for 88% of related party sales for FY12-17 or 39% of listed company’s total sales in that period.

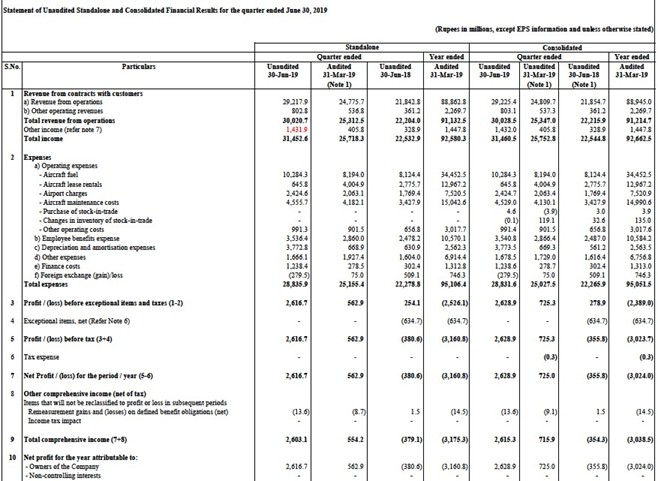

3. An Airline Company – A case of booking income not verified by the vendor

In Q1FY20, an Airline company recorded INR 143cr as Other Income

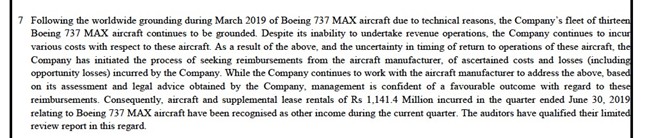

As per the note above which was part of the quarterly results, company recorded income of INR 114cr in lieu of expected compensation from Boeing for the Boeing 737 Max aircraft which were grounded by DGCA. Company believed that Boeing was liable to pay for the cost of maintenance of the aircraft including opportunity cost. However, there was no clear indication from Boeing for any such compensation.

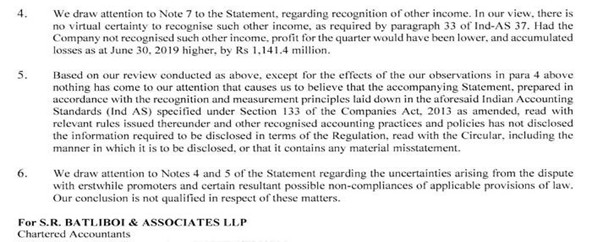

The auditors had to say the following.

Auditor clearly mentioned that there was no certainty of receiving any such income from Boeing. Such income should not have been reported in the P&L account until it was received. Thus, the company boosted its earnings by INR 114cr for that quarter.

We hope the above note and select case studies orients and helps readers detect warning signs of earnings manipulation via Revenues. Some of the most common reg flags are recording revenues before completing any obligation of a contract or recording revenue in excess of work completed and receivables increasing faster than sales.

We hope you enjoyed reading our compilation as much as we enjoyed putting it together.

Best Regards,

Parin Gala

VP – Research & Fund Accounting

Pratik Singhania

Senior Research Analyst

Yog Rajani

Research Associate

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.