SageOne Investor Memo March 2014

Quest for Outstanding Investments

Dear Investors,

Unpredictable behavior is the basic nature of equity markets and one witnessed it most recently when Indian markets jumped from the yearly lows to the yearly highs within a span of just 2 months. Markets have become increasingly volatile over the years and majority of the investors have had unpleasant experience investing in them trying to outsmart the market by predicting complex factors such as global macro, liquidity flow and market sentiments. Investors’ experience and returns have been further worsened by misleading/untimely advice from the investment advisory community whose incentives are driven by increasing assets under management rather than making money for the clients. No wonder very few investors in India are interested in investing in equities and we don’t blame them.

While we wholeheartedly empathize with investors who have had such experience, we strongly believe that equity investment as an asset class would generate the best long term returns (unleveraged and post tax) if done prudently. We say this with confidence because of our personal experience with the equity markets over the past two decades. Almost everyone generated handsome returns in equities during 2003-07 Bull Run, but only few were able to do so over the past 5-6 years.

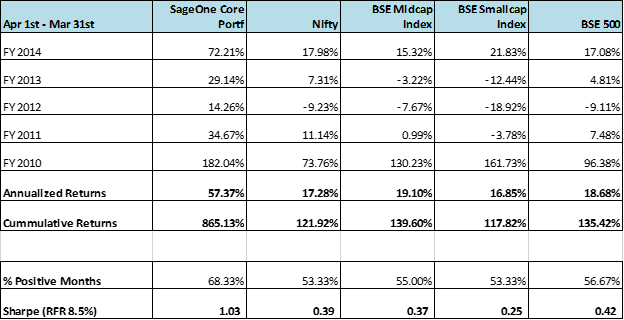

It’s been almost 2 years since we started our investment journey together and we believe it’s a reasonably long period to compare investment performance of our portfolio vs the market. You get your individual performance every month. Following table shows performance of the portfolio managed by us over the past 5 years. This is an actual portfolio that has been used to replicate client’s portfolio as and when they join. Most individual performances should cling to the below returns, adjusted for minor differences due to gradual buildup of the individuals portfolio done over a period of 3-6 weeks.

*Reviewed and audited by global audit firm KPMG

Model portfolio is a “representative” actual portfolio managed by the CIO in INR terms. Clients’ portfolio performance cling around similar returns but depend on their funds flow timing.

This Model portfolio performance over the past 5 years has been reviewed and audited by global audit firm KPMG.

We have written about our investment philosophy in the past newsletters, but since we have many new investors who have joined us during the past six months, let me take the opportunity to repeat few key aspects.

We all seek outstanding investments that provide superior returns, but how to achieve it remains the key question.

Investment Philosophy and Process

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

Charlie Munger

We are not striving for brilliance, but for consistency. To avoid making gross mistakes, it’s critical that we know what our strengths and weaknesses are and focus efforts on those strengths. We are not good at timing the markets, knowing short term market movements, predicting global macros or even knowing how liquidity is going to flow in/out of India. Hence even though we follow global economics, we do not want to take a call on it to generate superior returns. Our biggest strength is analyzing companies and business trends, hence we spend majority of our time doing that, where we believe we will get the biggest bang for our efforts.

Following are the qualities that we look for in all our portfolio companies.

Superior Business

We look for businesses with long-term competitive advantage, in a stable industry, that has a huge and growing market for its products/services. If a business is inferior then the price of the stock does not matter and it would not interest us. When you look at a business and if you get a feeling “I wish I owned this business”, only then it becomes a candidate for potential investment/share ownership. Competitors should find it extremely difficult to emulate such a company’s qualities and new players should find it tough to enter as a worthy competitor.

Financially the business should provide healthy return on the capital (ROCE and ROE) that has been invested without taking too much leverage (debt). Typically we look for sustainable ROCE and ROE of at least 20% but preferably above 30%. The business should have long-term growth potential of above 20% per year and it should not require too much additional dilution (other than for financial companies) of equity to achieve such growth.

Competent/Genuine Management

The most important factor in India is to stay away from managements that are here to steal from investors; and believe us we know of many. Here we maintain “zero” tolerance policy and we prefer letting go of a good opportunity even if we have some doubts about the management’s integrity. Once the management passes the above hurdle, we look for their competence in running the business and allocating capital. We want to associate with managements who use capital wisely and return any excess capital to the shareholders (in form of dividends) if there is lack of highly profitable opportunities available to invest in.

Reasonable Price

We would like to stress once more that our primary focus is on superior businesses and would not buy a weak business irrespective of its price. For a weak business which has no competitive advantage and which cannot sustain its returns (ROE/ROCE) above its cost of capital, no valuation multiple is low enough. We believe that the most important factor that drives value of any business is the “duration” over which the company can sustain its competitive advantage and hence superior returns. Once we understand this, we only invest in businesses where the price is below its intrinsic value considering its future growth and other quantitative/qualitative factors. Having sufficient margin of safety is very crucial when investing and paying low price provides that. We would rather hold the money and return it to you, than make a bad investment for the sake of it.

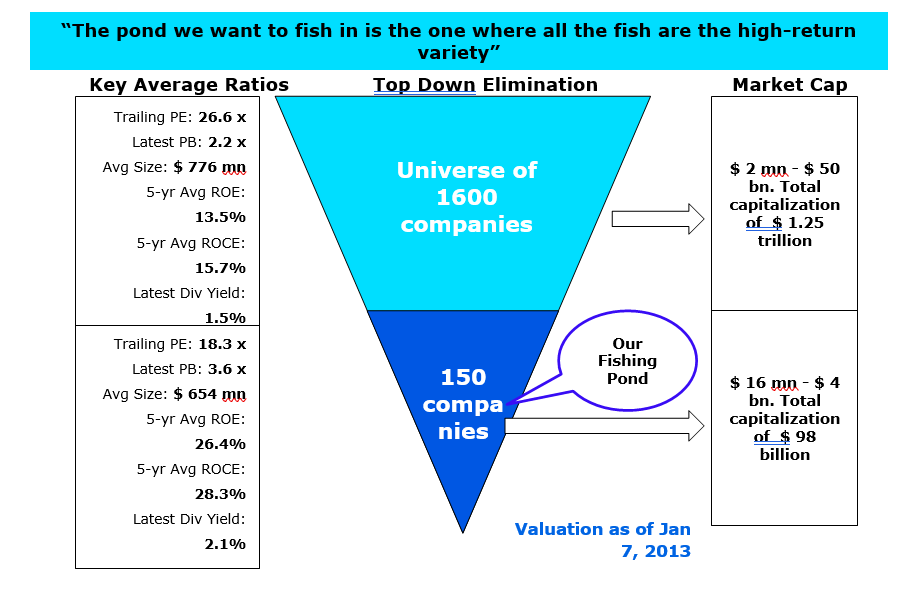

There are more than 5000 companies listed on NSE and BSE, out of which only about 1600 are of any size. We have used comprehensive filtering to shortlist about 150 companies that met our primary requirements. We not only went through quantitative parameters over past several years but also manually eliminated companies with suspect management. This forms our fishing pond to build our portfolio. We like “fishing in a pond where the fish is of high-returning variety”.

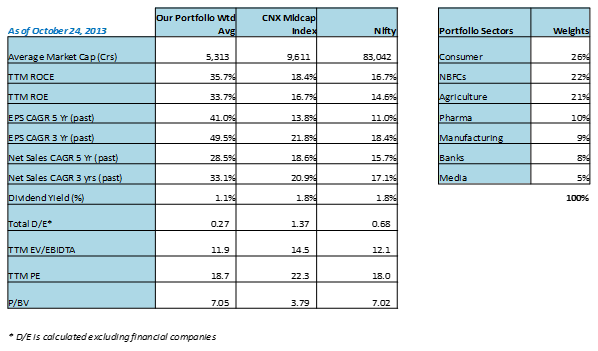

Sometimes few numbers reveal more that thousand words. We hope following parameters of our portfolio would reveal what kind of businesses we like to own:

**Nifty and Midcap Index parameters are weighted averages by using Market Capital as the factor. For the portfolio, we have used each stock’s weight/allocation in the portfolio as the factor.

What Should You Expect From Us

We are on a continuous Quest for Outstanding Investments. We only invest in superior businesses that continue to do well in the toughest of environments. We do not benchmark ourselves against the market indices and hence our portfolio may not have exposure to all the sectors represented in the Indian markets. That is mainly because we can’t find companies in certain sectors passing our growth and other hurdles that we discussed earlier. We expect our portfolio businesses to do much better that average in tough/recessionary environments and atleast as well as the average in good times. No one knows how the stock prices for these businesses will behave in the short term, but we expect investment returns from these stocks to track the business profit growth over a long term period of 2-3 years. We believe that for the risks that one undertakes in India by investing in the stock market, one should expect to make no less than 20% annual returns over a long term. Hence, if we don’t expect such a profit growth (and hence returns) from each of our businesses, we do not invest in that business.

How are We Different

→ Downside protection v/s upside participation: Prime focus on downside protection and best businesses.

→ Quality wins out: As a long term investor, we struggle with the “everything has a price” mantra. However, the fact is that companies with true franchise qualities such as leading brands, low cost structures and strong balance sheets perform better over a cycle than their lesser competitors.

→ In equities, if you can avoid purchases of bad business or overpay for good ones, the winners will take care of themselves. We believe most strongly that the best foundation for above-average long term performance is absence of lemons which permanently destroy capital. It is for this reason that a quest for consistency and protection, not single-year greatness, is a common thread underlying our investment process.

→ Alignment of Interest: More than 85% of our CIO’s assets in listed equities are in the same portfolio as yours. CIO will buy/sell at the same time and at the same price as for the clients for all future buys/sells. This may not be possible in cases where CIO already has a position along with existing clients.

→ No lock in clause. We want you to be our client because of our performance and not due to any legal right to lock your funds.

Our Thoughts on Equity Investments

Running successful businesses have made maximum people super-rich. Key here is “Successful”. Not all of us have the risk appetite and skills to own and run a successful business. So the second best option is to have small ownership in the best of successful businesses. That’s what investing in stocks provides us with.

Let’s look at what kind of returns can be expected from this asset. Our first guide is historical returns. India’s stock market (represented by Sensex and Nifty) has provided around 14-15% return over the last 2-3 decades. If you remove the last 5 years, the returns jump to 17%. Now is there any fundamental support behind such returns? India’s nominal GDP growth has been in the 13-14% (6-7% real GDP growth and 6-7% inflation) over that period. Stock markets follow earnings growth and earnings growth follows GDP growth. There is no reason to doubt that India would be able to continue on such growth path given India’s favorable demographics and increasingly ambitious new generation. If the overall market can grow at such rate, one can get better returns if one is able to pick a dozen of superior businesses from available 5000+ businesses that are presented to us via the stock exchanges.

Gold and Real Estate has had a super bull run over the past 6-8 years and we don’t expect such run to continue over the next 6-8 years. Equities have had stagnant period over the past 5-6 years. Given the kind of returns we were able to generate during such period, we strongly believe that equity investment as an asset class would generate the best long term returns (unleveraged and post tax) if done prudently.

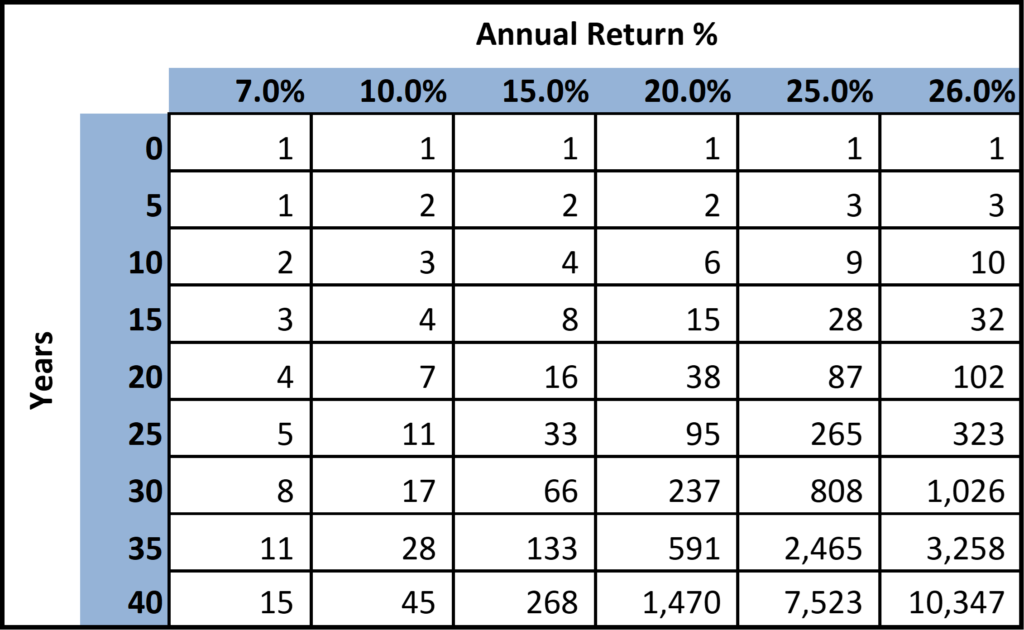

How Important are Additional Few % Generated by Superior Performance?

All of us intuitively know the power of compounding that is unleashed by investing over the long term, but most of us fail to realize the magnitude of this power. Below is a simple table showing how 1 mn investment grows over time. E.g. 1 mn invested at 7% (post tax rate on FDs) doubles in 10 years, and it multiplies 5x in 25 years. The same 1 mn if was invested in an asset returning 20%, would be 6x in 10 years and a whopping 95x in 25 years.

So someone investing in an asset returning 20% vs. keeping it in an FD has earned 90 mn more (opportunity cost/lost of 90 mn). To stretch this a bit further, 1 mn at 7% becomes 15 mn in 40 years, but the same 1cr becomes 10,347 mn (YES more than Ten Thousand Crores) if invested at 26% return. Most people don’t consider this as loss, but logically this is a huge lost opportunity. Every additional % adds mind boggling value over a long term. At 25% 1 mn becomes 7,523 mn vs. 10,347 at 26% over 40 years i.e. it makes a difference of more than 2800 mn. Think how much difference each incremental % would make to you and your next generation.

Running behind additional % return would be a big mistake if one doesn’t understand the associated risks. Choice of investment asset class is an individual preference and one should stick to what he/she understands the best or employ an advisor who understand that asset class and associated risks.

Transparency and Investor Communication

With more investors coming in each week, the demand on the Investment Team’s time to meet with investors on an ad hoc basis risks taking time away from investment decision making and analysis. At the same time, investors have a right to a high degree of transparency in their investments. We have always believed that the right informational standard is for you to receive the same information we would like to receive, if our positions were reversed; that is, if you were the investment manager, and we were the investor. I as the CIO will be writing to you a newsletter on a quarterly basis. We will provide more details on the improved reporting and further communication points in the coming few weeks. In the meantime please feel free to get in touch with us for any questions.

Warm Regards,

Samit S. Vartak, CFA

Chief Investment Officer and Partner

Email:sv@SageOneInvestments.com

Website:www.SageOneInvestments.com

*SageOne Investment Advisors LLP is registered as an Investment Advisor with SEBI.

Legal Information and Disclosures

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.