SageOne Investor Memo November 2012

Dear Investors,

Again it is our pleasure to be communicating with you on our investment journey together, via this formal memo. We intend to be writing to you frequently and the goal is to provide our investment performance and convey our thoughts on the investment environment going forward.

Our Performance So Far

We have sent your individual portfolio performance separately which will show a detailed portfolio position as of November 2012. During the Apr 1st – Nov 30th period of this fiscal year, the returns (excluding dividends) on our model portfolio has been around 29.1%. We will be providing detailed comparison of our performance vs. the market (Nifty 50) after completing meaningfully long period of 2+ years. Though returns cannot be guaranteed in stock market, we will strive for returns far exceeding the FD returns over a longer time horizon of 2 years and above. So far, we are satisfied that we have achieved better than market performance by sticking to very high quality businesses.

We want to take this opportunity to touch briefly on a simple concept of compounding.

Power of Compounding and Opportunity Cost

All of us intuitively know the power of compounding that is unleashed by investing over the long term, but most of us fail to realize the magnitude of this power. Compounding is our friend and we should employ it for as long as possible.

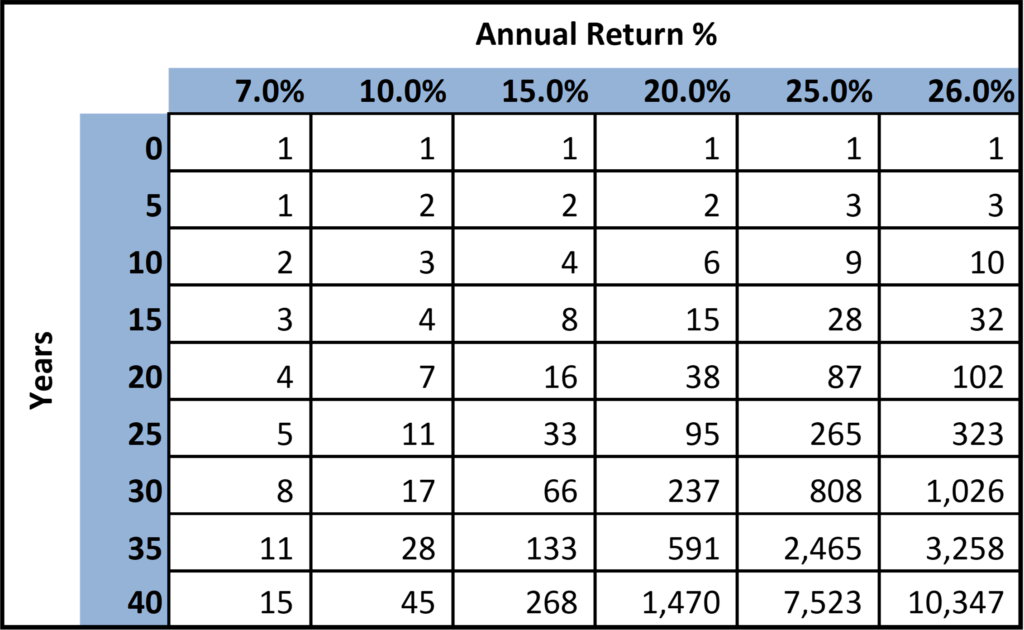

Below is a simple table showing how 1 cr investment grows over time. E.g. 1 cr invested at 7% (post tax rate on FDs) doubles in 10 years, and it multiplies 5x in 25 years. The same 1 cr if was invested in an asset returning 20%, would be 6x in 10 years and a whopping 95x in 25 years.

So someone investing in an asset returning 20% vs. keeping it in an FD has earned 90 crs more (opportunity cost/lost of 90 crs). To stretch this a bit further, 1 cr at 7% becomes 15 crs in 40 years, but the same 1cr becomes 10,347 crs (YES more than Ten Thousand Crores) if invested at 26% return. Most people don’t consider this as loss, but logically this is a huge lost opportunity. Every additional % adds mind boggling value over a long term. At 25% 1 cr becomes 7,523 crs vs. 10,347 at 26% over 40 years i.e. it makes a difference of more than 2800 crs.

Think how much difference each incremental % would make to you and your next generation. Now the big question is which assets can provide such returns. Let’s try and look at prominent assets that most in India look at.

Gold

Gold has given extraordinary returns over the past decade. The price of gold over the last decade has gone up from Rs. 5000 per 10 gms to Rs. 32500 currently. That’s an impressive 20.6% annual return. The returns don’t remain that impressive at 11-14% (pre-tax) when looked over 20-40 year period. Worse if you leave out last 5-10 years, the returns drop to 7-8% range, which are lower than the FD rates.

Key question is what kind of returns can be expected going forward. We are no expert on gold, but we will be surprised if gold provides double digit gains over a long term. Note that return on gold in $ term has been in single digits even if you include last 5-10 years. Biggest reason for gold to do well over the past decade has been the uncertain environment in the western countries. Rupee depreciation has provided additional returns in India. Many have bought gold just as a hedge to protect their wealth against big fall in value of major currencies such as $, Euro and British Pound. If Rupee was to appreciate going forward and if uncertainties over stability of western economies were to reduce, gold prices could even fall. Surely, if one has a very pessimistic future view of the world economy, gold is the asset to own. We are not in that camp.

Real Estate

Real estate has been the biggest money generator for most people in India. Returns vary widely across different locations, but most research show average returns to be in the 13-15% range. Mumbai probably has seen the biggest rise in rates; E.g. rate in Bandra East is currently 25000/sq ft, which was around 800/sq ft in 1985. The absolute increase seems mind boggling, but it is modest 13.6% (pre-tax) annual return. Advantage of investing in constructed properties is that you can fund it with bank loan and enhance return on your part of funds. Land has provided much higher absolute returns, but comes with added risk of clear title and encroachment. Plus it’s difficult to get loan on it and hence enhance the returns.

We believe that if you are not availing any loan, investing in land would be a better option compared to a constructed property. Key here is to reduce the above risks. If you can’t do that you may face risk of losing your capital. Protection of capital should be the prime focus in any investment. Land is a limited resource and given the population growth and demographics in India, its value has to appreciate for a long time to come. If one is knowledgeable enough in land dealing or knows someone who can do it for you, part of your investment should be in this asset.

Stocks

As you would have guessed, this is our favorite asset. Running successful businesses have made maximum people super-rich. Key here is “Successful”. Not all of us have the risk appetite and skills to own and run a successful business. So the second best option is to have small ownership in the best of successful businesses. That’s what investing in stocks provides us with.

Let’s look at what kind of returns can be expected from this asset. Our first guide is historical returns. India’s stock market (represented by Sensex and Nifty) has provided around 14-15% return over the last 2-3 decades. If you remove the last 5 years, the returns jump to 17%. Now is there any fundamental support behind such returns? India’s nominal GDP growth has been in the 13-14% (6-7% real GDP growth and 6-7% inflation) over that period. Stock markets follow earnings growth and earnings growth follows GDP growth. There is no reason to doubt that India would be able to continue on such growth path given India’s favorable demographics and increasingly ambitious new generation. If the overall market can grow at such rate, one can get better returns if one is able to pick a dozen of superior businesses from available 5000+ businesses that are presented to us via the stock exchanges.

Our View

Almost everyone we know is running behind investing in real estate and gold. The exact opposite is true of stocks. Most want to stay as distant as possible from it. Typically superior returns are made by investing at a time when not many are interested. That’s the time when you get ownership in great businesses at reasonable/attractive prices. We are worried to invest during good times when you can still invest in great businesses, but at exorbitant prices. That’s what happened in 2000 and 2008 when everyone wanted to invest in stocks and it was the worst time to do it. Current is surely not such time. Stock markets have gone nowhere in the last 5 years and we won’t be surprised if they make up (following mean reversion) in the next 5 years.

In my first newsletter, I had written about the approach we follow in choosing businesses to partner with. What returns one gets in the short term is not entirely in ones control as it depends on multiple domestic and global factors, but over a long term your returns should mirror the earnings growth of these businesses. We are in constant lookout for such great businesses that should grow (per our analysis) earnings at more than 25% annually. What gives me confidence going forward is that this approach has given me more than 60% (per year) return over the last 3 years during a time when most investors have lost money and economic conditions were unfavorable. If we get better economic conditions domestically and globally, our chances of achieving high returns go up significantly.

One more reason we strongly favor stocks as an asset class is that it provides capital to businessmen in a capital starved country. Gold and land are idle assets and keeping money idle helps the country in no way other than saving money for bad times. Let your money also work for the great entrepreneurs while providing you the returns.

One should stick to assets that he/she understands including the accompanying risks. Happy Investing!

Should there be any queries, I’m always available. Please do not hesitate to contact me.

Warm Regards,

Samit Vartak, CFA

Chief Investment Officer

Legal Information and Disclosures

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.