SLMP Investor Memo September 2024

Greetings,

We take this opportunity to share the second memo of our SageOne Large and Midcap Portfolio (SLMP). Our first memo discussed our investment philosophy and thought process. It outlined the investment objective, catalysts for higher Alpha generation (process of selection and allocation), portfolio construct, etc.

The second memo marks the completion of 1 year of managing client funds in SLMP. Through this memo, we wish to answer some of the most asked questions and highlight various aspects of the portfolio such as the portfolio performance, key contributors to the performance, key portfolio ratios & metrics, churns, stock entries and exits, liquidity of our portfolio companies, etc. We have also discussed how we perceive risk and reward at the current levels.

How has been the performance of SLMP so far?

The last 1 year has been one of the most resilient periods for Indian equity markets with drawdowns of major indices being at just 3% over the course of the year. Series of events like rising geo political tensions, election results, increase in capital gains, etc. were supposedly big shocks for Indian equity markets as reflected in sharp drawdowns. However, these sharp drawdowns were also absorbed by the market very quickly. Strong domestic flows coupled with India’s superior and stable macroeconomic tailwinds could be the primary reasons.

The performance of SLMP over this period has been encouraging but the focus remains more on the investment process rather than the performance. Our endeavor is to achieve consistent and stable alpha generation over long periods of time. We strive to keep refining our investment process proactively in accordance to evolving business/market cycles.

*Returns are net of costs and fees and a combination of managing proprietary funds from 1st April 2022 up to 24th August 2023, followed by managing client money. Returns greater than 12 months are annualized returns. BSE 200 TRI is assumed as BSE 200 returns plus dividend yield of 2.4% p.a.Note: Returns of individual clients will differ from the above numbers based on the timing of their investments. Past performance is not an indication or promise of future performance. The performance related data has not been verified by SEBI.

How do these returns compare on a relative basis?

Portfolio returns have been on the higher side vs our long-term aspirations on an absolute basis. Hence a relative comparison would be more apt for this period. As most other competitive offerings in the large cap space are Mutual Funds, we have compared our performance to the top Mutual Funds below:

Performance comparison of SLMP for period April 2022- Aug 2024 (i.e. proprietary + client funds)

Performance comparison of SLMP for period Aug 2023- Aug 2024 (i.e. client funds)

*Returns of Top 10 Large Cap and Top 10 Large and Midcap MF (by AUM) are median returns

**Best MF is Top Performing MF from the Top 10 Large Cap and Top 10 Large and Midcap MF (by AUM)

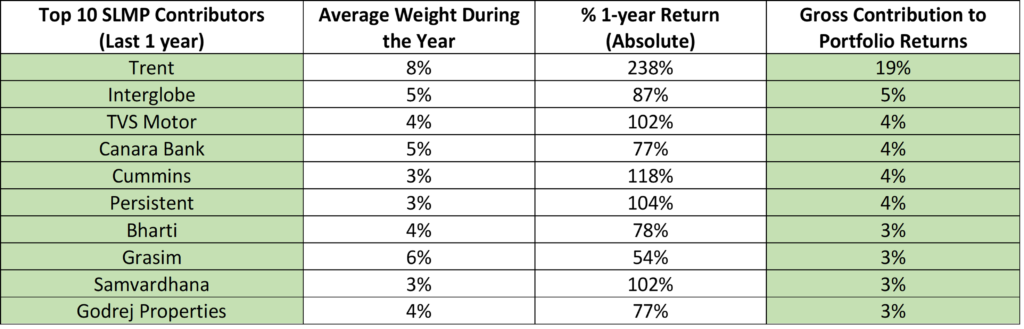

Which were the top contributors to SLMP performance over the last 1 year?

→ Portfolio performance has been fairly distributed and not concentrated to one sector. Top 10 contributors to the overall portfolio return are all from different sectors.

→ Trent which had the highest weight and our top conviction buy, has been one of the performing stocks in our entire fishing pond. Barring 5 PSU companies, Trent has been the top performing private sector stock in the Top 200 companies (by market cap) since we started managing client money.

→ 12 of the Top 25 and 15 of the Top 30 performing stocks in the last 1 year (from the Top 200 stocks) were PSU companies. The superior SLMP performance vs benchmarks / MFs has been without any material exposure to PSUs. We held ~ 10% in PSUs, confined only to the power and BFSI sector. Our participation in railways, defence, oil and gas has been negligible due to the lack of predictability and lack of our understanding of these sectors.

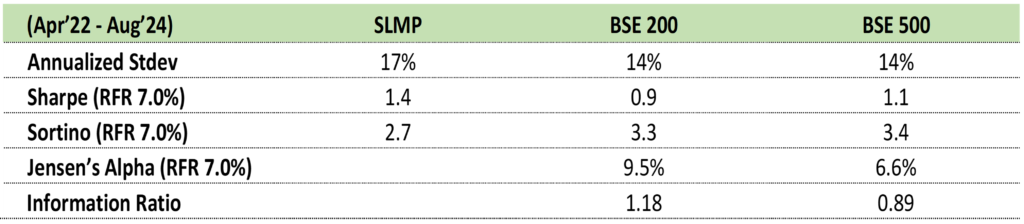

What are some of the important performance ratios?

Performance ratios should be seen in context of a long-term history or track record. However, based on our available performance data so far (i.e. April 2022-Aug 2024), some observations are as follows:

→ Higher Sharpe/Information Ratio indicates superior risk adjusted returns of SLMP over benchmarks

→ Lower downside ratio of SLMP implies lesser portfolio fall in periods of negative index returns

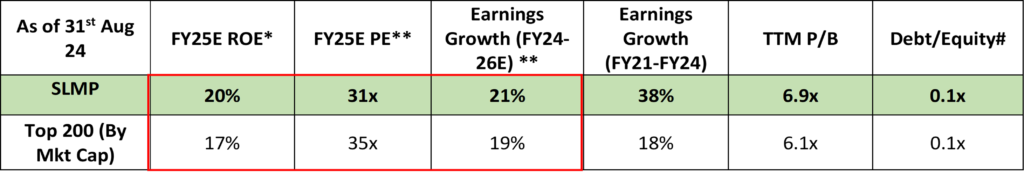

What are the key portfolio metrics?

Our portfolio metrics are an outcome of our constant focus to pick companies having superior growth and Return on Equity (ROE) metrics, at fair/reasonable valuations.

Source: Ace Equity, SOIM – All ratios are median numbers

#Ex BFSI *Based on Bloomberg consensus estimates **Based on our estimates

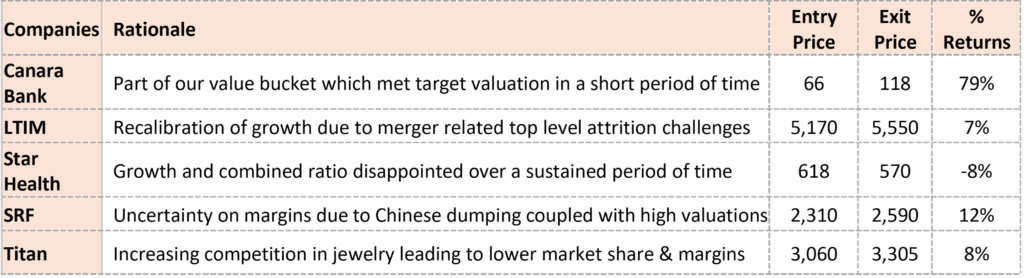

What was the overall churn of the portfolio?

The portfolio has seen a churn of ~20% (based on average weight of a stock during its holding period). This was well within our targeted churn rate of 20-25%. There have been 6 exits – 5 of these were exited in the range of -8% to +12% returns due to lack of clarity on medium term growth along with availability of better opportunities. 1 of the exits was a tactical call which achieved our targeted return. As can be seen from the low churn rate, we have refrained from taking momentum-based calls, which has been the flavour of the market over the last year. While these may boost short-term outperformance, they don’t lead to sustained consistent alpha creation. Beyond these complete exits, we have done weight adjustments (additions/trims) in our model portfolio holdings, in line with our risk–reward and risk management framework.

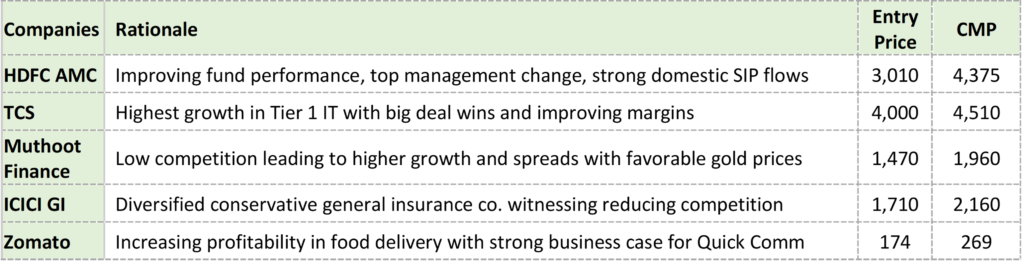

What were the key entries and exits over the last year?

Key Exits

Key Entries

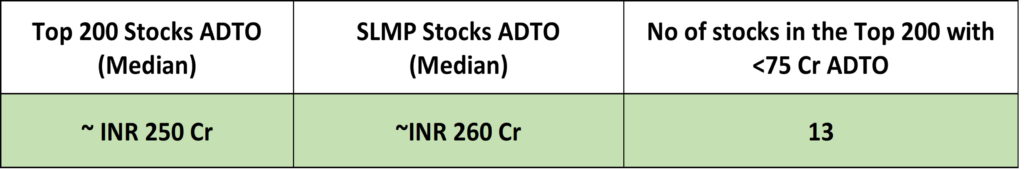

Can a larger AuM size be a deterrent for SLMP performance in future?

AUM size should not a deterrent to performance of SLMP, considering it is a large cap-oriented portfolio with highly liquid stocks and negligible impact cost.

To corroborate this, we analysed the Average Daily Turnover (ADTO) of the Top 200 Companies (our fishing pond) and also for our portfolio.

Note: This is based on ADTO of the last 6 months

Just 13 companies from the Top 200 companies have an ADTO of less than INR 75 Cr. Assuming SLMP AUM crosses INR 1,000 Cr (~10x size of our current AuM), a 5% allocation to any company, would require purchase or sale of INR 50 Cr worth of stock. Given the high Median ADTO of Top 200 companies (~INR 250 Cr), impact cost or availability of stock are not expected to be limiting factors even with a much higher AUM.

We remain disciplined on the liquidity criteria even at current AuM size. We refrained from purchasing a company with liquidity lower than INR 50 Cr even though there was a very favourable risk to reward. Our current AUM would have permitted us to purchase and exit this company but whilst it would boost short term performance, it would not be unsustainable over a longer term.

What are our thoughts on risk to reward at the current levels?

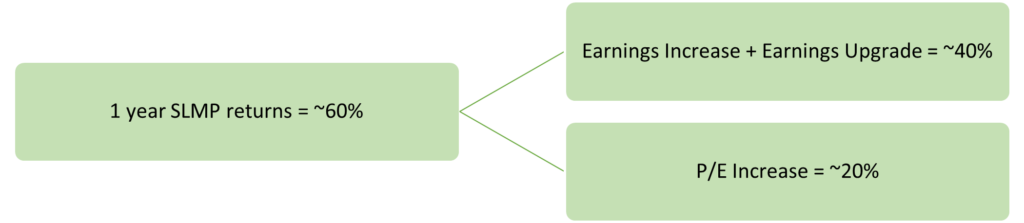

Given the buoyancy in the markets, a common and important question on everyone’s minds is on the current valuations. Future Portfolio returns are a combination of Future Earnings Growth and Price to Earnings (P/E) change. A fall in P/E will affect future returns and therefore does remain an important factor to monitor. Beyond company specific fundamentals, P/E ratio is also driven by changing sentiments, liquidity and macro-economic developments which are tough to forecast. Our efforts are more focused on the earnings growth, which are relatively easier to forecast based on our understanding and assessment of each business.

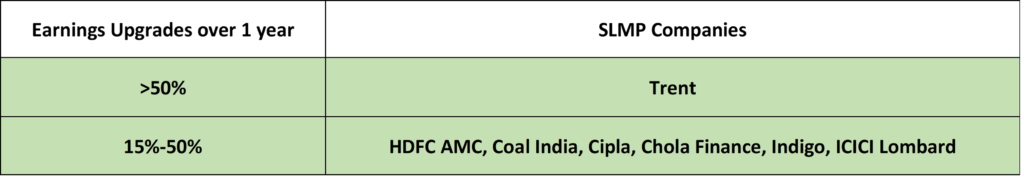

The ~60% returns of SLMP over the last 1 year when dissected between P/E and earnings growth gives us comfort. Returns were driven by earnings growth and earnings upgrades v/s just a change in P/E.

~2/3 of SLMP companies witnessed earnings upgrades over the last 1 year on account of exhibiting better than expected fundamental performance v/s estimates. These upgrades range from 5% to 50% range. The balance 1/3 companies have not seen material earnings downgrades inspite of these being present in sectors not having a conducive environment (Banking, IT etc.). Notable earnings upgrades in portfolio companies are:

EPS CAGR of ~20% is expected for the SLMP portfolio over the next 2 years. Hence even if valuations were to slightly de-rate, we should be close to our aspirational returns CAGR of 16-18%. The focus remains on identifying companies having strong earnings growth and companies with a scope of earnings upgrades, not factored in by the street. Superior earnings growth aids in providing a good margin of safety in an environment of high valuations. Any interim correction and therefore drawdown in portfolio should make risk to reward more favourable for SLMP.

Have there been any recent learnings?

Our last memo highlighted a few key learnings. Unfortunately, the subsequent period has been one of the most non-volatile phases with every stock and sector performing well. In such an environment, it’s difficult to judge the performance or have any material new learning. A correction would cover the current excesses in a few pockets of the market. Not every company in our portfolio would be immune during times, and hence any such event would provide us with more learnings to further improve our process.

We have rectified one of our mistakes mentioned in the earlier memo. We had missed buying Zomato inspite of repeated surprises on the profitability front. We spent a lot of time understanding the Quick Commerce model and its massive opportunity size, coupled with Zomato’s superb execution and expected strong cash flows across all its business lines. We included Zomato in our portfolio in June 2024 at valuations within our comfort zone, by taking advantage of the volatility in the markets during election results.

We have exited companies such as Titan, SRF, Kotak and LTIM due to disappointment on key operating metrics, uncertainty regarding the future earnings and and with better availability of other opportunities. We have repeatedly spoken about our emphasis on earnings growth, operating metrics of companies, predictability of earnings growth along with reasonable/fair valuations as the corner stone of our investment philosophy.

We hope to explain our concept of operating metrics of different companies in our subsequent memos along with examples. This should provide a better understanding of the same.

What is the current outlook?

→ Q1FY25 was a subdued quarter in terms of earnings growth, on account of inclement weather and elections. However, underlying growth for the country and corporates is still expected to be robust without much change in future expectations. Strong corporate balance sheets, government balance sheets, bank balance sheets, strong private and government capex, cooling inflation; all point to a stable domestic macro environment.

→ Our last memo discussed how large caps as a space was ignored which had led to underperformance of the Nifty vs broader benchmarks. However, the large cap space has started to witness flows after a subdued period, resulting in similar returns for Nifty and other broader benchmarks recently.

→ While valuations are relatively on the higher side, for anyone with a 4–5-year view, this still remains a good time to invest in the large cap space with potential to generate superior returns with moderate risk.

→ Interim volatility owing to global factors or valuation excesses cannot be ruled out.Equity markets have a characteristic of being nonlinear with markets witnessing drawdowns of 10-15% every year on an average including within periods of a bull mkt cycle.

→ The focus should be on avoiding greed in the current environment of easy returns and avoiding fear in the context of markets making new life time highs every day. The power of compounding, a rational risk to reward strategy and a strong investment process should be the foundation. With a strong foundation and a disciplined approach, the odds of a successful investing journey of consistent alpha generation over long periods of time, becomes a reality.

To conclude, the first year has been smooth with returns materially higher than our long-term aspirations. Stock picking and alpha generation could get incrementally challenging. We would like to keep focusing on our process and let the performance be an outcome of the process. Inspite of overall markets trading at relatively high valuations, we continue to aspire for a 16-18% CAGR from here as well, through are well crafted bottoms up investment approach, implying doubling the portfolio in 4.5-5 years post fees and expenses.

The minimum ticket size for SLMP is INR 50 lacs and there is NO exit load. We have kept our fee structure extremely competitive vs other similar large cap funds. SLMP could be considered as an alternative or an option for any investor’s existing or new Large Cap equity allocation.

Samit’s guidance, experience of our research team and constant channel checks will continue to help us in the stock selection and elimination process of our portfolio going forward as well.

Thank you for always having faith in SageOne and we hope that we continue to deliver to our clients through this new offering and look forward to your participation.

Warm Regards,

Satish Kothari & Kshitij Kaji

Fund Managers, SLMP

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.