The Importance of Earnings Growth

Dear Investors,

One of our recent knowledge series titled “Importance Of Process In Investing” discussed how having a robust process, and following it with discipline, has led to the eventual success of a few fund managers. There can be different processes in investing such as technical analysis, momentum-based investing, fundamental analysis etc. Fundamental investing itself has different approaches like value or growth. As discussed in that note, there is no right or wrong process. Any process that is carefully developed and time tested across market cycles with constant iterations, and implemented with discipline, is likely to yield consistent and stable alpha generation. Given the importance of a good process, this knowledge series tries to dissect SageOne’s Investment Process.

SageOne’s Investment Process

Our founder and CIO, Mr. Samit Vartak, through many of his memos and interviews has spoken in depth about SageOne’s Investment Process. This well thought of and crafted process has been implemented successfully, yielding superior and consistent returns for SageOne clients. The bedrock of this process has been the Importance of Earnings Growth while evaluating businesses. Across all our portfolio constructs, this remains the single most important factor, which is explained in this note.

What are stock returns made up of?

Stock investments do not have a linear or a fixed return like fixed income instruments and are deemed riskier. Investments are made in different companies with the hope of an increase in the value of a company in the future, resulting in an increase in the investment value. The key risk is the reverse of the same.

The increase/decrease in the value of a company is driven by just 2 components:

Example:

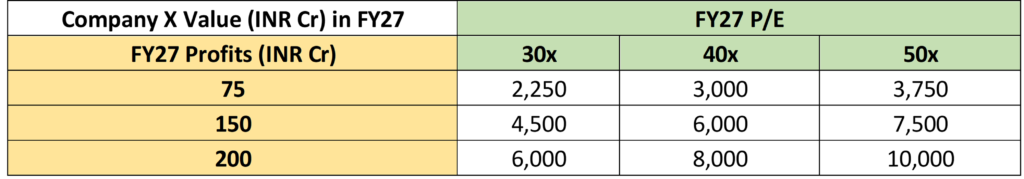

Company X reported profits of INR 100 Cr in FY24 and the market capitalization (value) of the company was INR 4,000 Cr. This implies that the company was valued at 40 times of its reported profits or Price to Earnings (P/E) multiple is 40x.

If in FY27, the company reports a profit of INR 200 Cr, the value of the company will be dependent on the P/E multiple in FY27. If the multiple is 30x, the value of the company increases to INR 6000 Cr and if the P/E multiple is 40x (same as earlier) then the value of the company has become 2x its original value (in line with its profits growth). If the profit shrinks to INR 75 Cr and the P/E falls to 30x then the company value will fall from INR 4,000 Cr to INR 2,250 Cr. Below are a few scenarios that show that the value of the company will change depending on the profits and the P/E multiple in FY27.

Hence the future value of the company is dependent on the increase/decrease in earnings of the company and the increase/decrease in its P/E or valuation multiple.

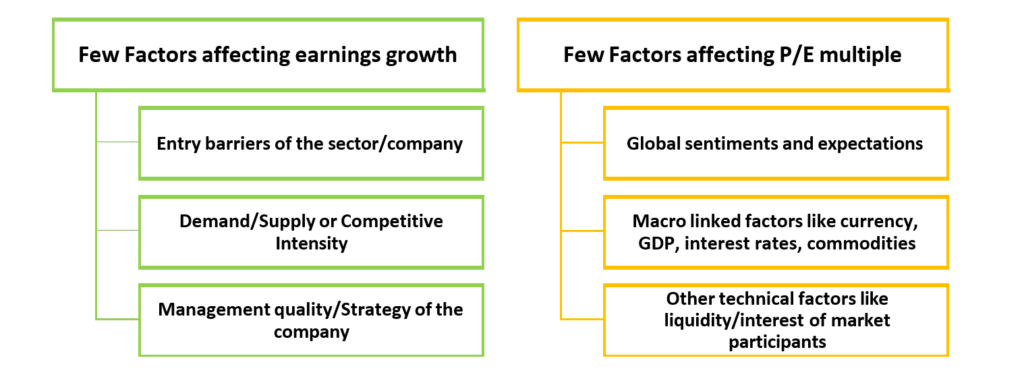

Which of the 2 components should an investor focus on?

Both the components are influenced by certain factors. Logically, an investor should focus on the component where the factors affecting it are relatively easier to predict. Below are the some of the factors affecting both these components:

Judging by the factors that are driving the above 2 components, it’s very evident that it is much easier to predict a few micro factors related to a particular company/sector rather than multiple macro factors which have global linkages and a series of cascading effects which are almost impossible to predict. Hence it would be easier for an investor to focus on earnings growth.

What are the various components of a strong earnings growth?

There are many companies that forecast robust earnings growth but only a few achieve it. Some companies show high earnings growth for a short period of time, but find it hard to sustain on a higher base. Earnings doubling is not just based on mathematics, but on the strength of the underlying business models. As India is one of the fastest growing economies in the world, it is easy to forecast growth on an excel sheet but the actual outcomes tend to vary materially.

As a business witnesses’ cycles, the onus is on the investor to study the following:

a) Predictability of the earnings growth (business strength during tough times)

b) Longevity of the earnings growth (earnings growth potential is long term or short lived)

c) Underlying drivers/operating metrics of the earnings growth (management quality, capital allocation, market share gains, underlying volume growth, profits translating to cashflows, etc)

While some of these are quantitative, the rest are qualitative. Hence, inspite of having similar excel models and growth estimates for companies, portfolios of various investors are materially different.

Does correctly predicting the earnings growth, provide a margin of safety in investing?

When investing in the markets, many great investors have alluded to management of risk being more important than making a return. Warren Buffett suggested 2 rules of investing – Rule No.1 is “Don’t lose money” and Rule No.2 is “Don’t forget Rule No.1”.

We are trying to predict only 2 components – earnings growth and change in P/E to determine the future investment return. A company achieving an increase in earnings growth satisfies the first component. If an investor were to go wrong on the second component (P/E multiple), the fall in value of the company is mitigated to a certain extent due to the earnings growth.

If over a 4-year period, earnings of a company doubled (increased 100%) but P/E fell by 10%, an investor would still make 80% returns, inspite of overpaying during the purchase.

If a company is growing fast at 30%, and falls by 20% in the current year due to high valuation, its P/E is almost 40% cheaper than the previous year, which makes it much more lucrative. For a slow growing company, the fall in stock price is not as impactful.

Example:

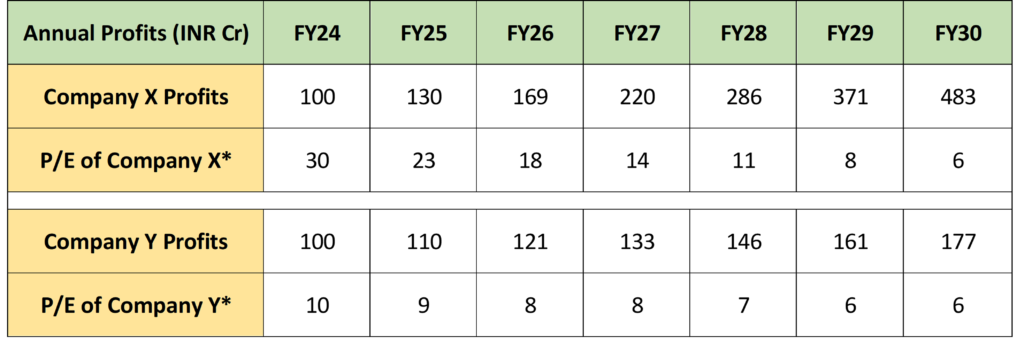

Company A and Company B are both currently doing INR 100 Cr of annual profits. Company A is growing at 30% every year and is trading at a 30x P/E (company valuation of INR 3,000 Cr). Company B is growing at 10% every year and trading at a 10x P/E (company valuation of INR ,1000 Cr).

*Assuming company valuation remains the same

Over a longer period of time, both companies converge to a similar P/E ratio. If a company has a higher earnings growth, over time the P/E of the company will reduce much faster. If both companies were 40% overvalued, Company X would be at its optimal P/E in less than 1.5 years but Company Y would be at its optimal P/E in 3-4 years, thus increasing the payback period. Hence if one can correctly predict the earnings growth, risk is mitigated even if an investor were to slightly go wrong with the P/E component.

In our assessment over the years, resilient and superior earnings growth of a company is rewarded with a higher P/E and lesser chances of a P/E de-rating. Hence, focusing on earnings growth provides a natural hedge against a P/E de-rating.

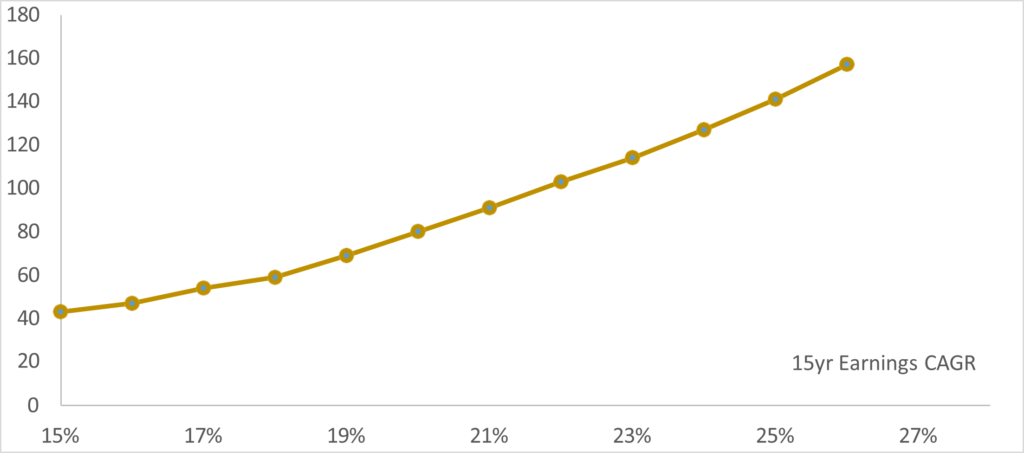

Below is an example showing how P/E tends to expand as long-term earnings forecasts increase, keeping a fixed set of assumptions. A company that can grow at 15% for 15 years would trade at 40x given these assumptions. However, as the growth rate increases to 20%+ for a 15-year period, the P/E expands to 80x.

How can an investor attempt to reduce the risk even further?

An investor can reduce risk further by buying a company with strong earnings growth, at fair/reasonable valuations (valuations similar to its long-term averages or valuation of peers). It is rational to assume that if purchased at fair/reasonable valuations, the P/E multiple will not change much during the investment horizon, and hence stock returns should be similar to the earnings growth of the company during this period.

However, investing only in the fastest growing companies is not a prudent investment approach as it often happens that companies with very high growth, already trade at a high P/E (future earnings growth is captured in the current price). By investing in such companies, an investor runs a dual risk of earnings growth being lower than expectations and a subsequent decline in the P/E.

Therefore, along with earnings growth, the entry valuations are important but not as important as predicting the earnings growth correctly.

How do SageOne portfolios stack up in terms of earnings growth?

At SageOne we look for doubling of earnings over a particular timeline, for different portfolios:

→ SSP = ~3 years (earnings and portfolio returns compounding by ~25% every year)

→ SCP = ~3.5-4 years (earnings and portfolio returns compounding by 20-22% every year)

→ SLMP = ~4.5-5 years (earnings and portfolio returns compounding by 16-18% every year)

This helps investors have a fair idea of the returns across holding periods, for different portfolios.

Once earnings have doubled, should one exit?

Given the fast-changing disruptive world, it has become extremely difficult to predict events over long-time frames. Typically, SageOne’s holding period for companies is ~3-5 years in different portfolios. However, there is no set rule of exiting a company just because it has doubled. Sometimes there are multiple tailwinds or megatrends which last for many years. Selling a company just because its doubled, would mean that an investor may miss out on these megatrends.

It is important to continuously evaluate companies at every juncture and see whether the company is a) doubling earnings growth over the investment horizon, and b) available at fair/reasonable valuations – both from the current juncture. The holding period can be extended till the time both these conditions are met.

Conclusion

Investing involves making a judgement on future events and how market participants collectively react to those events. A good investment process is having a relatively time-tested model where an investor can expect reasonable upside along with mitigation of risk across long periods of time. Therefore, it’s important to have a simple process and follow it with discipline.

Having to forecast just one variable – “earnings growth” seems really simple but as Warren Buffett has said “Investing is simple but not easy”. Understanding the underlying layers of earnings growth takes hard work and a lot of experience. One needs to ask all the right questions to finally take a judgement call on whether the earnings growth will double and whether the entry level valuation is fair/reasonable.

It’s impossible to perfectly estimate the earnings growth of every company. Assumptions need to be tweaked regularly due to events which are outside one’s control such as changing competitive dynamics, effects of globalization, regulatory changes, etc. Therefore, it’s important to create a portfolio of companies which meet the return expectations.

Most of the times, a few stocks in the portfolio turn out to multibaggers (high earnings growth along with large P/E re-rating), a few stocks disappoint (no earnings growth and/or a fall in the P/E multiple), while the remainder may perform in line with expectations.

For every company in any SageOne portfolio, we cast a keen eye on the future earnings growth and the entry valuations for a higher margin of safety. At times, certain overweight calls on stocks or sectors may not work in our favour, as a) earnings growth, or b) the market reaction to such growth, tends to be lumpy causing short term underperformance. However, over the long term, we expect our portfolios to achieve returns similar to the growth of the underlying stocks in the portfolio.

We look forward to hearing your valuable feedback and suggestions on our knowledge series notes. We shall continue to take up interesting topics to help educate you further and in turn learn from you via your feedback. We hope you enjoyed reading this note.

Warm Regards,

Kshitij Kaji,

Vice President – Research Fund Manager – SLMP

SageOne Investment Managers LLP

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.