Looking at Businesses the ESG way

Dear Investors,

I am pleased to share our new note as part of our Knowledge Series initiative on “Looking at businesses the ESG way”. In the previous note, my colleague Anand Sable had decoded concepts of risk adjusted performance statistics.

As an investment team, it is always our constant endeavor to look out for ways to improve our investment philosophy and incorporate meaningful factors that can contribute towards better stock selection and elimination. Over the past 3 years, the concept of ESG has started to dominate headlines in financial journals, newspapers and investor conferences in India. Several of our stakeholders have also shown interest in whether SageOne gives any consideration to ESG factors in its decision making. This note is an attempt to decipher some salient features of ESG, its increasing role in Indian markets, and most importantly ‘SageOne’s ESG Way’.

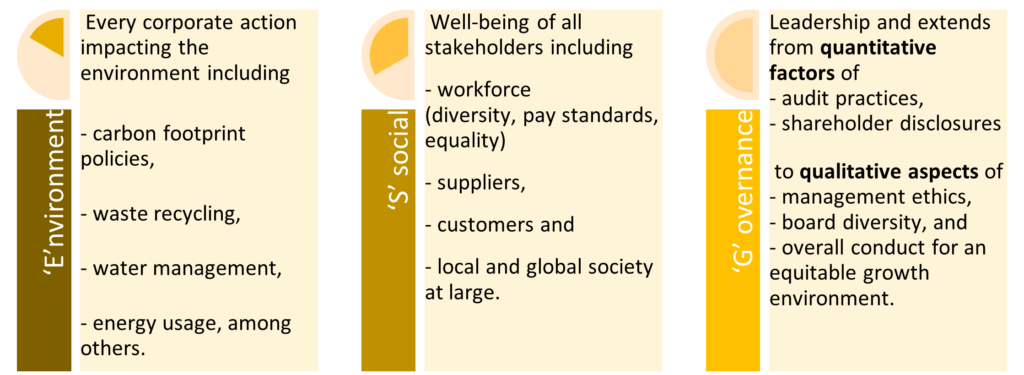

‘Environment, Social, and Governance’ i.e. ESG factors define all that needs to be focused upon by entities to progress towards a sustainable growth path.

Fund management houses can incorporate ESG factors on simple exclusionary screening (eliminating businesses on the basis of negative ESG impact like high carbon footprint, poor corporate governance etc.) or have a more sophisticated ESG integration approach (by applying ESG considerations to fundamental analysis and security selection).

Simply put, analyzing and incorporating these ESG factors to investment research can lead to a holistic investment analysis and convert into better-informed investment decisions. At the least, risks can be minimized, against the same or better returns.

ESG is suddenly a buzzword

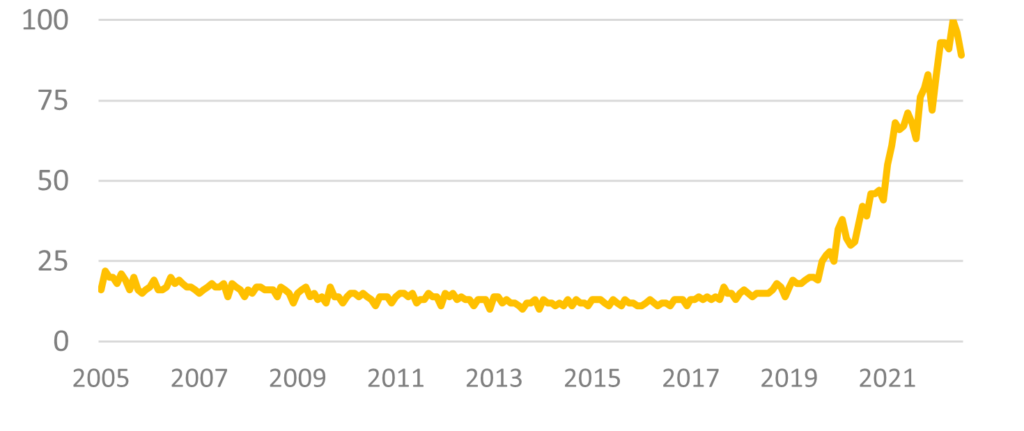

In the last 5 years, ESG popularity has increased nearly 4-fold as suggested by Google Trends:

Numbers on the y-axis represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular.

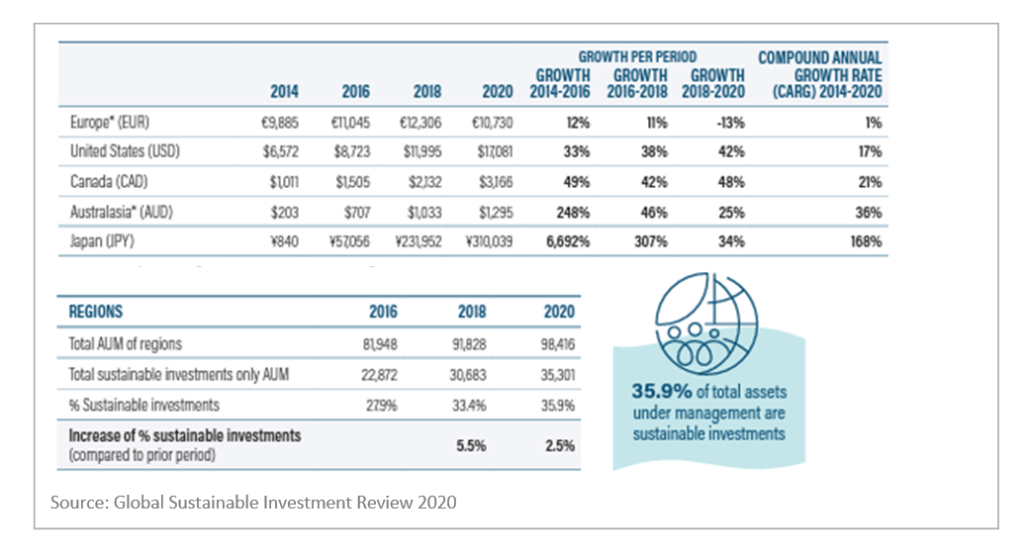

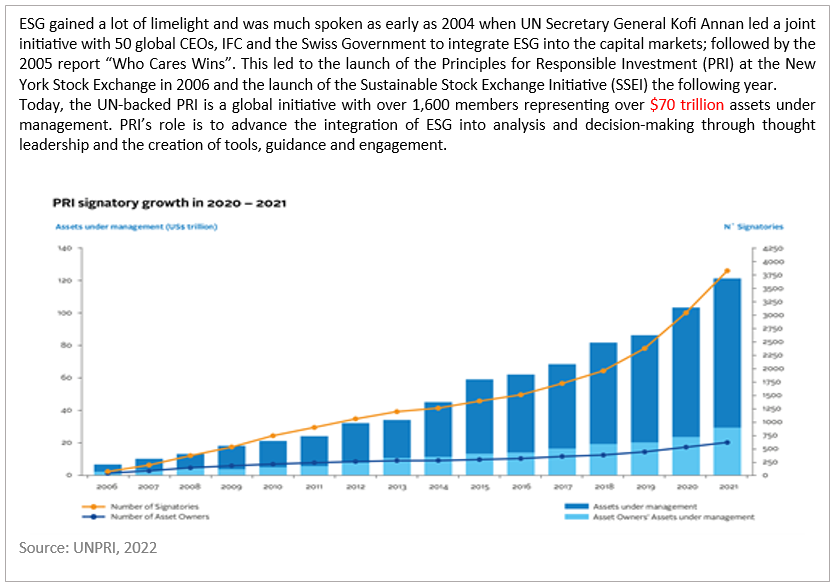

A similar trend is also visible in the growing assets under management (AuM) of ESG funds. While Europe and US led the growth till 2020, subsequent contribution is expected to be from Asian markets with Japan being the front-runner. (Refer Appendix 1)

What has led to this change?

Every year, increasing impacts of adverse climate change are being felt and seen around us. Glaciers melting near the poles, global warming, environmental pollution, wildfires, rising sea levels, all have culminated into significant loss to human lives and economies at large in many parts across the world. While it is not an individual, or a one-day activity to have led to these impacts, (in fact, a lot of it may be beyond one’s control altogether) it does warrant taking a step-back and assessing how our initiatives as world community members in general, and investors in particular could encourage a step towards the sustainable side of things.

In the world of long-term investing, investors have started to acknowledge the limitation of ‘long-term’ given the uncertainties about viability of numerous business-models.

How does a company keep growing when the entire ecosystem around it could vanish?

Beyond the moral obligations, companies with positive ESG considerations have been seen to have two notable implications based on numerous studies and evidences:

- ESG integration can improve financial performance over long term due to improved risk management, resource utilization, talent retention and stakeholder relationships.

- Companies with positive ESG initiatives have lower downside risk, especially during a social or economic crisis.

Where does India stand?

Though ESG investing is at a nascent stage in India, it is fast gaining momentum. Almost all of the 15+ ESG funds in India have been launched in the past 2 years indicating a recent trend emergence. As per 2020 CFA Institute Survey, more than ~70% institutional and retail investors showed interest in ESG investing, while less than ~15% were actually investing in ESG funds. Definitely, there is substantial room for growth.

The global commitments made by India such as reducing its carbon emissions by 30% by 2050 and procuring 40% of its energy from non-fossil fuel sources by 2030 require pro-active policy measures. Studies by Impact Investors Council (IIC)1 2020 have pointed out that meeting the Sustainable Development Goals (SDGs)2 in India requires an annual investment of USD 0.6 trillion (~1.4 times Indian government’s annual budget). Significant private/corporate participation is expected to be the key to achieving this.

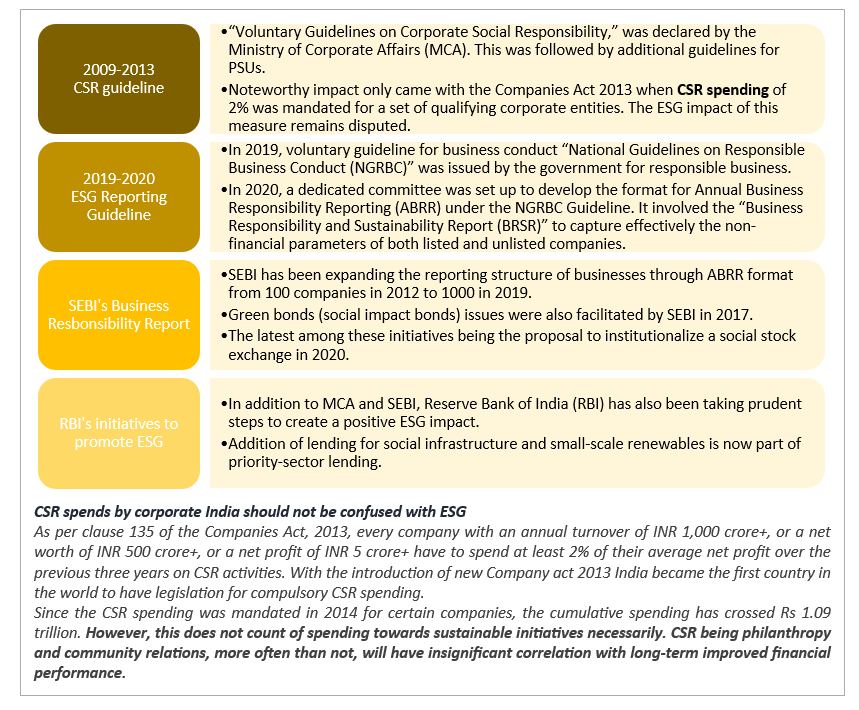

In the timeline of events from 2009 till 2022, multiple regulatory bodies have directed corporates towards ESG contribution through policies and regulations. (Refer Appendix 2)

In a nutshell, two key trends (from the government) are paving the direction of sustainable investing in India

- Government policies and initiatives have evolved from voluntary ones to mandatory ones

- Significant emphasis on reporting and disclosures on ESG parameters by corporate entities

According to global estimates, nearly 100+ global ESG funds managing over USD 25 billion have invested nearly 18% of their investible corpus to Indian companies. Within India, total AuM of domestic ESG funds estimate to USD 1.5 billion having grown 5.5x in the last 3 years (2019-2022) as per Morningstar estimates.

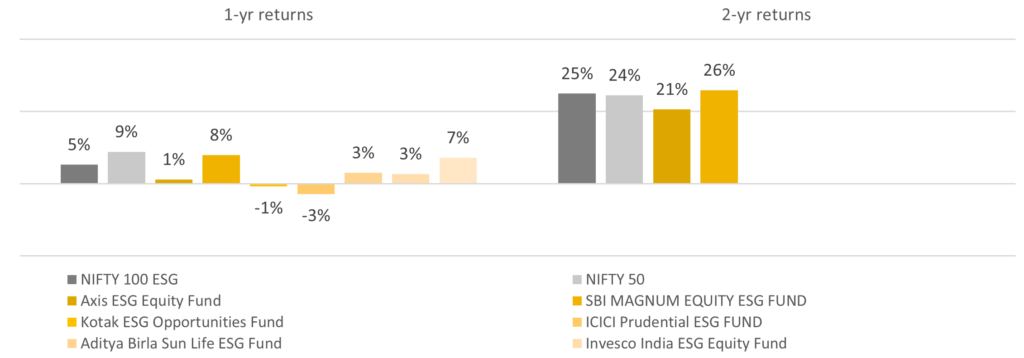

The top 7 ‘ESG’ named funds by AuM have underperformed the broader index NIFTY 50 (based on 1-yr return ending July, 2022). Nevertheless, with a fund life of less than 2 years for 5 out of 7 of these, it is difficult of comment upon their long-term value addition for investors.

Source: AMFI, NSE, SageOne

Note: Returns are for period ending 31st July, 2022

Amidst all the moral and financial factors supporting the emerging trend of ESG funds, few limitations must also be noted:

1) Fiduciary duty limited to maximizing shareholders’ wealth: Institutional Investors for a long time argued that ESG issues were not adding any value to their primary agenda of maximizing shareholder value. However, several papers have been written on the financial implications of positive ESG considerations, especially in the longer term.

2) Data and Analysis barrier: Limited availability of data and tools to assess companies globally on ESG parameters has been a major hindrance till date. Inconsistency in reporting, numerous independent ESG assessment metrics and incomplete information has left a lot to the judgement of the assessor.

3) Problem of plenty: Numerous ESG Rating agencies have different criterions which are neither standardized nor regularized leaving investors in an inconclusive zone. Over 80 exchanges have reported their own ESG reporting guidelines. While Bloomberg and Thomson Reuters have more than 100 metrics and sub-metrics, MSCI only has 35 key metrics taken into consideration for their ESG ratings.

4) Cost-benefit analysis: ESG funds incur significantly higher costs towards data gathering and research. Additionally, fees charged by ESG funds could also be higher considering their focused and niche approach. Against these additional expenses, it has become more challenging for ESG funds to outperform their broader market peers and make a firm place in an investors’ portfolio.

SageOne’s ESG Way

SageOne investment principles lay emphasis on a.) high earnings growth, b.) superior corporate governance and c.) sustainable competitive advantage for the selection of our portfolio companies. In pursuit of these key attributes, we have also grown closer to companies with strong ESG practices and eliminated the ones we were uncertain about.

Long-term wealth creation for all stakeholders remains our primary objective and this could only be possible if both our core research and general business practices are sustainable in nature.

Environment

Our portfolio companies adhere to the respective industry related environment regulations. Further, zero discharge plants, low carbon footprints, and increasing share of renewable energy sources are some of the key environment-related factors being adopted by companies.

Beyond addressing the environmental cause, these factors also increase the useful life of manufacturing units and could provide significant cost advantage to the businesses in the long run. Lower maintenance capex and lower manufacturing expenses can ultimately contribute to the bottom line of the company. Pro-environment manufacturing practices could also give businesses incremental global opportunities as a wider set of global entities are giving consideration to ESG factors when choosing these business partners.

Case: A mid-size chemical company with strong product profile and growth prospects faced setback due to a major accident led by illegal dumping of hazardous waste sourced from the company. If proven guilty, it could lead to license revocation of the company as well. Although the matter stands settled with a penalty post 3 months of the charges, our team at SageOne continue to remain vigilant of the implications of such anti-environment practices.

Social

Well-being of customers, suppliers and workforce is the key to long-term sustenance of any business. Average employee tenure and their ownership of the role speaks volumes about their satisfaction levels at work. During company visits, we pay more attention to interacting with mid and junior level employees and understand their view of the business practices. Unless internal stakeholders are satisfied, there is a significant chance for the bitter effects to trickle down to suppliers and clients.

Channel checks with suppliers and clients give meaningful guidance on the longevity and growth prospects of any entity. We have often taken calls against businesses on the basis of negative stakeholder feedback and found such companies losing market share in the medium to long-term.

Increased efficiency of tenured employees, better business terms from long-term suppliers, and higher wallet share from satisfied customers, all percolates to improved profitability of businesses.

Governance

Strong governance is an undisputed factor for selection of investible businesses. It encompasses management interest and ethics, board diversity and conduct, incentive-linked salary structure of key employees and business heads, comments from the auditors, among other qualitative and quantitative factors. Most of the quantitative factors can be assessed through an in-depth analysis of annual financial statements. We also run a thorough forensic check on company financials through our in-house model before concluding on them. Any red alerts are first discussed with the management for rationale and resolution, then evaluated for buy/sell decisions.

Management history of shareholding actions and their impact on minority shareholder interests are also seriously evaluated. Multiple business interests of promoter can also compromise growth of the core business and leave minority shareholders at dismay. We have rejected companies where promoter family has set up businesses in multiple countries beyond its core listed entity as it could dilute their focus.

Several qualitative factors concerning top management have also been discussed in detail in our 3rd knowledge series on Qualitative Analysis – Traits of a Quality Promoter.

ESG at SageOne is at the core of our investment philosophy and due consideration is given to each of the above discussed factors in our research process. We would yet not call ourselves an ‘ESG’ fund as it is not the primary selection criteria for us. As an elimination tool, we give significant attention to ESG violations and in the process attempt to reduce the risk element from our portfolio.

We look forward to hearing your valuable feedback and suggestions on this initiative of ours. On our part, we shall continue to take up interesting topics and add to your knowledge. We hope you enjoyed reading this note.

Best regards,

Neha Agarwal

Vice President – Research and Business Development

SageOne Investment Managers LLP

- Indian government formed the Impact Investors Council (IIC), an industry representative body, to drive the impact investments in India and to represent the impact investors in the country ↩︎

- SDGs were a series of 17 goals as part of the United States 2030 Agenda for Sustainable Development. It includes objectives likes universal education, saving water supply, and sustainable economics. ↩︎

Appendix 1

Appendix 2

Appendix 3

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.