SageOne Investor Memo October 2024

View PDF

View PDF Dear Investors,

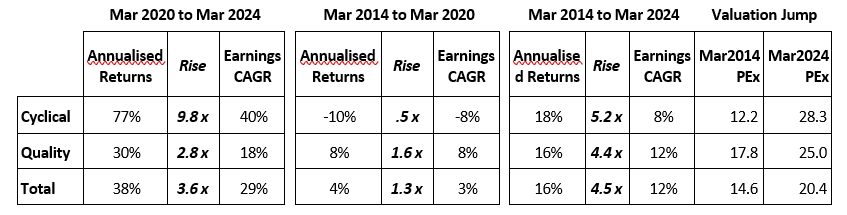

Since March 2023, the Indian equity market has experienced an impressive growth following a 15-month pause after the strong bull run that began in March 2020, post-COVID lows. This rise has been primarily driven by cyclical stocks, which saw a compounded annual growth rate (CAGR) of 77% (or an 10x increase) from March 2020 to March 2024. During the same period, quality stocks delivered a more moderate 30% CAGR (or a 3x rise). Prior to this, from March 2014 to March 2020, cyclical stocks saw negative returns (-10% CAGR), while quality stocks delivered an 8% CAGR. The recovery of cyclical stocks has been truly remarkable.

Looking at the performance over the last decade under the BJP regime (March 2014 – March 2024), surprisingly cyclical stocks have outperformed quality stocks with 10-year CAGR of 18% and 16% respectively. Interestingly, between March 2003 and March 2024—spanning two decades—the CAGR for cyclical and quality stocks has been the same at 21%, despite significant differences in their earnings quality, earnings growth, business risk and return on equity (ROE) profiles. A detailed classification of these stock categories, along with further analysis, is presented in the subsequent sections of this memo.

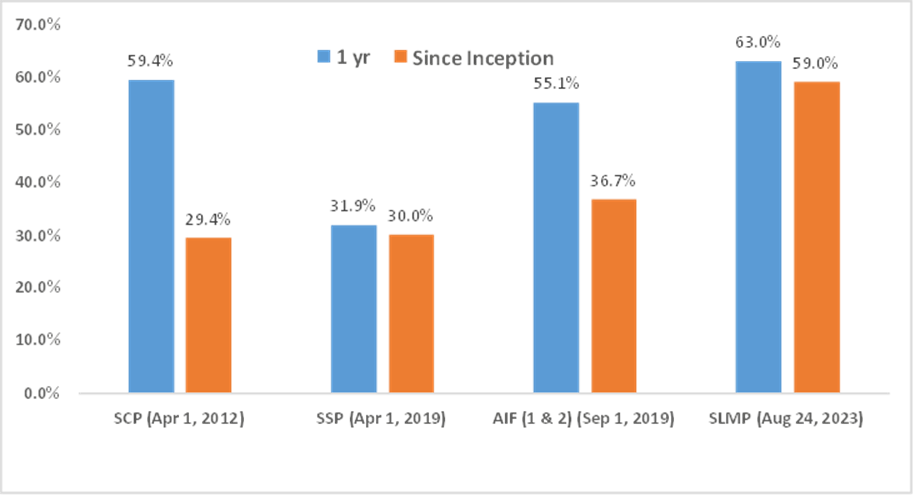

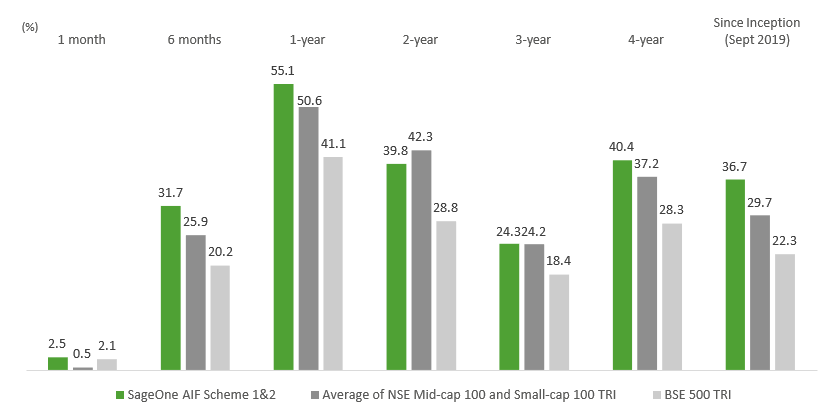

In the past twelve months (September 2023–September 2024), our flagship core portfolio (SCP) delivered a 59.4% return (net of fees and expenses), the small-cap portfolio (SSP) delivered a 31.9% return while our AIF (a blend of SCP and SSP) returned 55.1%. We also introduced a large-cap oriented portfolio (SLMP) a year ago which delivered a 63% return over the same period, thanks to the fund managers Satish Kothari and Kshitij Kaji. A comprehensive analysis of long-term performance is included at the end of this memo.

One year and inception-to-date performance of various Sage One portfolios

We remain committed to managing our assets responsibly and have set strict limits on each strategy to avoid significant drag on returns due to excessive fund size. For example, we paused new fundraising for SSP at the end of 2022 upon reaching capacity. Our AIF – Scheme 2 was closed for new fund raise in January 2023. Despite these limitations, we are pleased to report that our assets under management (AUM) have recently surpassed ₹7,200 cr, supported by favorable market conditions and your continued trust. I cannot thank you enough for the unwavering support and confidence you’ve shown over the past 12.5 years, through all the ups and downs.

Markets Scaling All-time Highs

As markets continue reaching all-time highs, the issue of how to navigate through overvaluation remains a common topic of discussion with diverse opinions. In my previous memo, I shared valuation metrics for different market segments (by market cap) in relation to their historical context and outlined our strategy for navigating such conditions. Not much has changed since then. I also presented an analysis highlighting areas that were significantly overheated, some of which have since corrected by 20-40% from their peak.

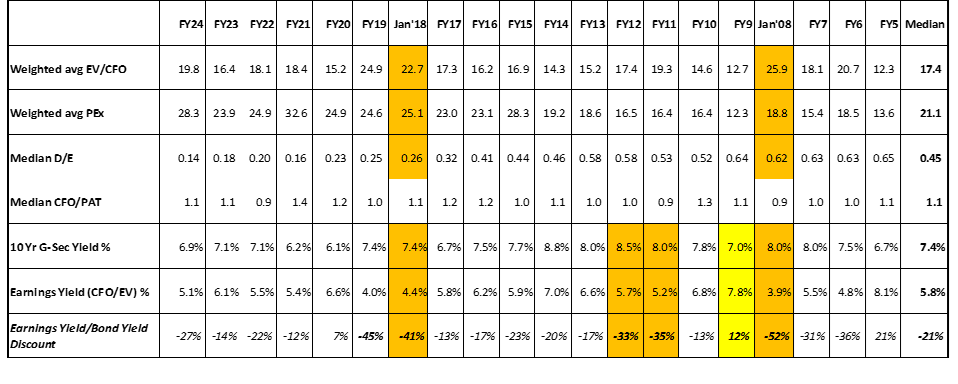

In late 2021, I had presented an analysis highlighting how corporate India’s balance sheets and operating cash flow (CFO) had reached their strongest levels in history, even as markets were similarly overvalued. I also detailed how small-cap indices had experienced crashes every 2.5 to 4 years over the past two decades, with an average drawdown of more than 45%. However, I believe that due to the strength of corporate balance sheets and CFO, following the 2021 peak, small-cap indices corrected by only half of their historical average. They then swiftly recovered those losses and reached all-time highs in a short period. Below is the updated analysis for the largest 1,000 non-financial listed universe in India having 20-year history.

Debt-to-equity ratios have declined to their lowest levels, and EV/CFO metrics remain below those reached in March 2006, January 2008, January 2018 and March 2019. Given the balance sheet strength and slightly overvalued EV/CFO, while corrections of 10-20% are possible, a market crash seems unlikely. I believe that attempting to time these corrections in an effort to add alpha could result in significant opportunity costs for a long term fundamental based investor.

There is a general consensus that mid and small-cap stocks have reached euphoric valuations, and while it’s true that their valuations are more stretched compared to large-cap stocks, there’s a critical difference. While large caps offer around 100 stocks to build a portfolio from, the mid and small-cap universe offers over 900 companies with a market capitalization above

₹2,000 cr. For investors like us with limited AUM discipline and seeking 15-20 high-growth companies with reasonable valuations, it’s still feasible to construct an attractive portfolio. Naturally, the challenge increases as the number of stocks grows. Moreover, as AUM rises, the pool of investable stocks shrinks, forcing a shift toward both a larger number of companies and larger-sized firms. This also reduces the flexibility of exits, often compelling investors to adopt a long-term horizon by necessity rather than by choice.

Outperformance of Cyclical Stocks and Lessons from this Bull Run

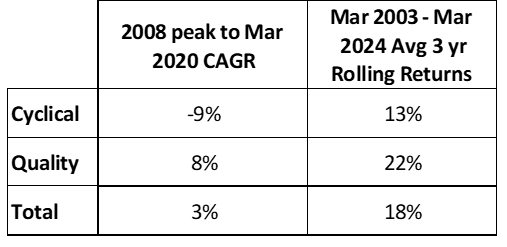

Returning to the point I mentioned earlier, I was surprised to find that cyclical stocks have outperformed quality stocks over the past decade. There’s a widely held belief that investing in high-quality companies—those with strong ROCE, sustainable margins, consistent earnings growth, and capable management—typically leads to long-term outperformance, both against benchmarks and lower-quality businesses. While this holds true in many instances, it hasn’t played out over the last decade. Below is a table that highlights the performance of cyclical and quality stocks over various time periods.

Note: This data is for 400 companies (out of the largest 1000) who have data since 2003. Classification of Cyclical Vs Quality companies has been done using a combination of median ROE levels, volatility in profitability (indicating consistency) and subjective judgement. Both buckets have around 1/3rd companies each and the remaining 1/3rd companies are not classified in either buckets. Cyclical companies include segments such as commodities, mining, PSUs, real estate, construction and infrastructure.

The outperformance of cyclical companies since the post-COVID lows has been remarkable, driven by significantly higher earnings growth and lower starting valuations. This has more than compensated for their sharp underperformance between March 2014 and March 2020, when cyclical stocks halved in value while quality stocks rose by 1.6x. As a result, over the past decade of the BJP government, cyclical stocks have outpaced quality stocks, delivering an 18% CAGR compared to 16% for quality stocks.

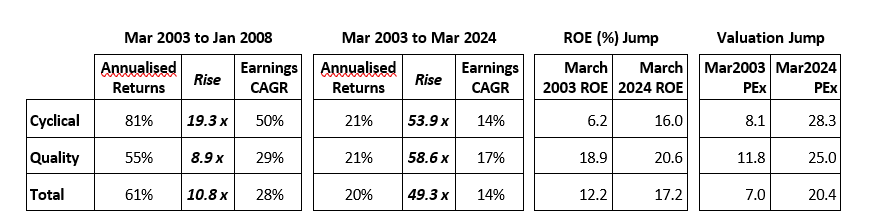

Now, let’s examine a much longer time frame. Below is a table comparing the performance of cyclical and quality stocks since 2003.

During the major bull market of 2003-2008, cyclical stocks sharply outperformed quality stocks, driven by significantly higher earnings growth and lower starting valuations. Even more remarkable is that over the 21 years from March 2003 to March 2024, the returns from both categories are nearly identical at 21% CAGR. While the earnings growth of the quality stocks was superior over this period, higher valuation rerating for cyclical stocks offset the gap in earnings growth.

Point-to-point returns can sometimes be misleading, as they may obscure the risks encountered along the way. For instance, between January 2008 and March 2020, cyclical companies delivered a negative CAGR of 9%, compared to a positive 8% for quality companies, creating an alpha of 17%. To better understand the consistency of returns and minimize the impact of entry and exit timings, it’s helpful to examine the median of rolling returns. We analyzed three-year rolling returns at the end of each year (2003 to 2006, 2004 to 2007, and so on) over the past 21 years and calculated the average of those returns. As shown in the accompanying table, quality companies delivered an average 3 yr rolling returns of 22% CAGR versus 13% for cyclical companies, creating an alpha of 9%. This is far cry away below the 21% point-to-point returns for the cyclical bucket.

Our strategy has always focused on identifying companies that are expected to double their earnings in 3 to 4 years with high certainty, backed by our research. In most cases, when earnings growth materializes, valuations are rerated—regardless of whether the company is cyclical or quality. While predicting cyclical earnings cycles can be challenging, by being patient, selective and choosing opportunities with relatively higher predictability, one can still find attractive investment ideas in both buckets.

The performance of cyclical companies over the past 21 years defies conventional wisdom, highlighting the importance of maintaining an open mind as a fund manager and considering opportunities across the entire spectrum. It also underscores the critical role of entry valuations. Even a few years of underperformance can erode alpha and potentially jeopardize one’s professional investment career. Beyond point-to-point returns—which can look impressive following a strong bull run—it’s essential to acknowledge the inherent risk of cyclical stocks. These stocks are prone to extended periods of negative performance, sometimes lasting for over a decade. For a fund manager, it becomes extremely challenging to retain clients when returns are this concentrated and marked by prolonged downturns.

While constructing an optimal portfolio it’s important to be aware of the risks of both the buckets.

Following a broad-based rally, where PE multiple rerating has significantly boosted returns over the past four years—and where the PE multiples for cyclical stocks have even surpassed those of quality stocks—we believe that future returns will be primarily driven by earnings growth. However, the pool of companies capable of delivering high earnings growth is likely to be narrow, making stock picking increasingly critical. Companies that fall short of earnings expectations could see sharp corrections in both valuation and price.

Wishing you success in navigating what is expected to be a more challenging investment environment ahead.

Warm Regards,

Samit S. Vartak, CFA

Founder and Chief Investment Officer (CIO)

SageOne Investment Managers LLP

Email: ir@SageOneInvestments.com

Website: www.SageOneInvestments.com

*SageOne Investment Managers LLP is registered as a PMS and an AIF with SEBI.

Appendix

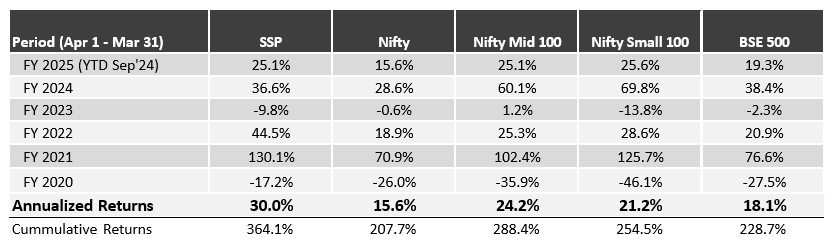

SSP* Portfolio Performance (Net of Fees)

Source: SageOne Investment Managers, Bloomberg, Wealth Spectrum. *SSP is SageOne Small cap Portfolio

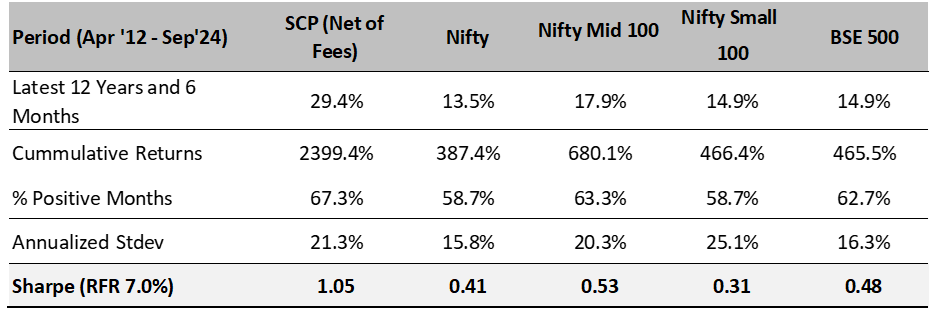

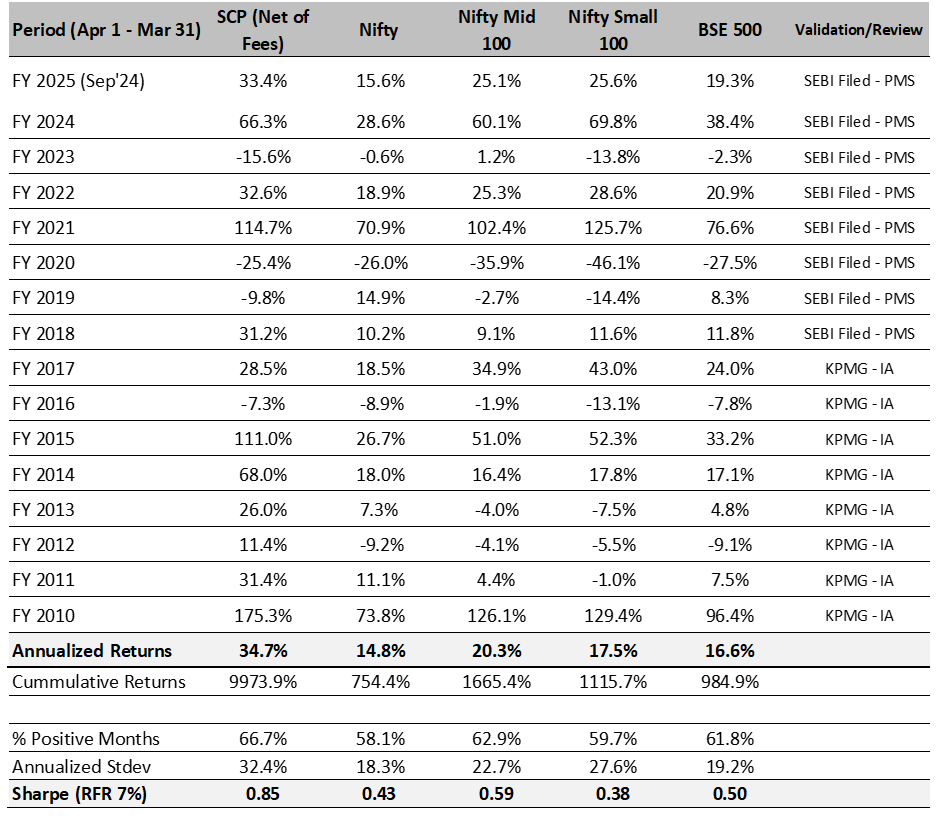

SCP: Latest 12 Years 6 Month Performance (Apr 2012 – Sep 2024)

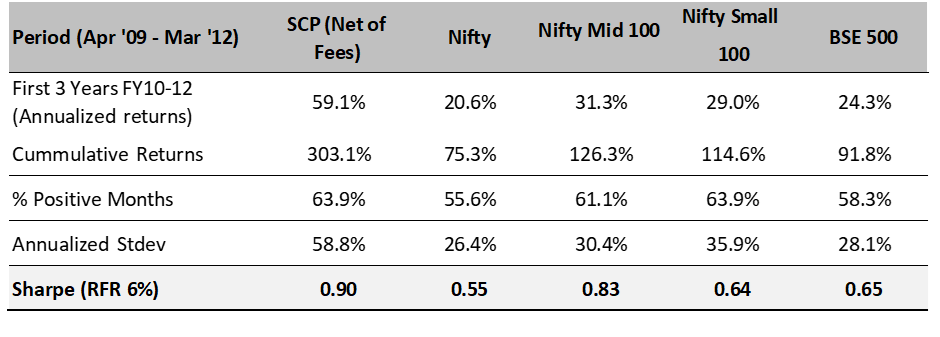

SCP: First 3 Years Performance (Apr 2009 – Mar 2012)

*We have consciously changed the composition of the core portfolio in terms of the average size of companies and the number of stocks in the portfolio after we started advising external clients in April 2012.

*The weighted average size of stocks at the start in FY10 was below $0.25 bn which has increased to nearly $4.6 bn by the end of Sep ’24. Also, the number of stocks has increased from 5 (+/- 2) in 2009 to 16 (+/- 4) during the past 11 years and 11 months.

SageOne Core Portfolio (SCP) Performance (Net of Fees)

For the first three years, we managed proprietary funds and for the last 11 years and 1 month we have been advising/managing funds for external clients. Since clients have joined at various stages, individual performance may differ slightly based on the timing of purchases. For uniformity and ease, we measured our IA performance using a “representative” portfolio (that resembles advice given to clients) and we call it SageOne Core Portfolio (SCP). SageOne core portfolio is not a dummy/theoretical portfolio but the CIO’s actual total equity portfolio. The representative portfolio until FY17 was reviewed by KPMG. Post that the performance is for the PMS scheme. Calculated on a TWRR basis for the entire period.

15 Years and 6 Months Performance in INR (Apr 2009 – Sep 2024)

Source: SageOne Investment Managers, Bloomberg, Wealth Spectrum

Performance of SageOne AIF Scheme – 1 & 2 (Net of Fees)

Note: Our AIF is a blend of SCP and SSP. The above data is of SageOne AIF Scheme 1 from Sept’19 to June’22 and of AIF scheme 2 from June’22 till date (Sep 30, 2024).SageOne AIF Scheme 1 was fully redeemed between June’22 to Aug’22 and most investors reinvested the proceeds in Scheme 2. Scheme 2 is closed for new fund raise since Jan’23

Legal Information and Disclosures

Any performance related information provided above is not verified by SEBI.

This note expresses the views of the author as of the date indicated and such views are subject to changes without notice. SageOne has no duty or obligation to update the information contained herein. Further, SageOne makes no representation, and it should not be assumed, that past performance is an indication of future results.

This note is for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or financial products. Certain information contained herein concerning economic/corporate trends and performance is based on or derived from independent third-party sources. SageOne believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information or the assumptions on which such information is based.